The XAU/USD pair scored a gain of 0.83% on Monday as low prices lured some investors back to the market. The XAU/USD pair traded as low as 1226 but prices reacted with bullish sentiment after hitting that low and moved back up. Also the disappointing pending home sales data helped prices regain their footing following losses last week. The latest massive gold sell-off was initially ignited by speculations that the U.S. Federal Reserve will turn down the tap on its $85billion/month stimulus package sooner than anticipated.

I highly doubt the Fed will pull the trigger at its next policy meeting because early January could see another budget/debt ceiling battle between the Republicans and Democrats. I think the XAU/USD pair is a perfect example of why it is necessary to trade the markets as they are, not as they should be and because of that I will be sticking to the charts as always.

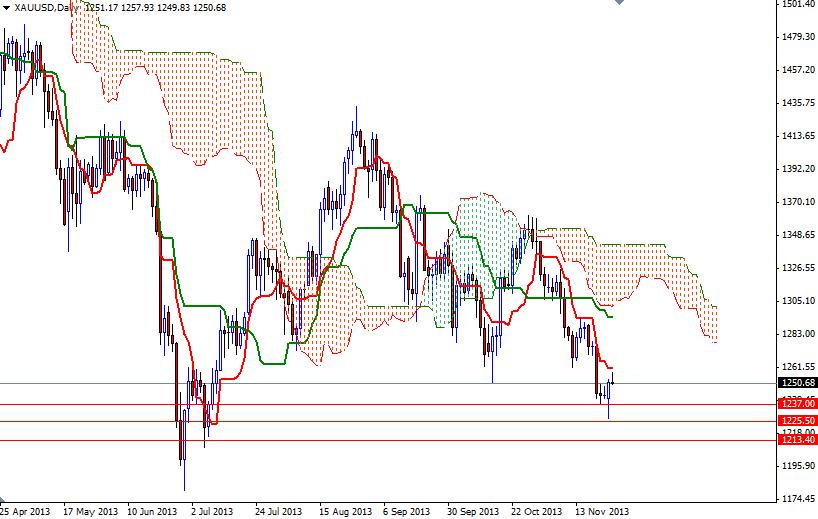

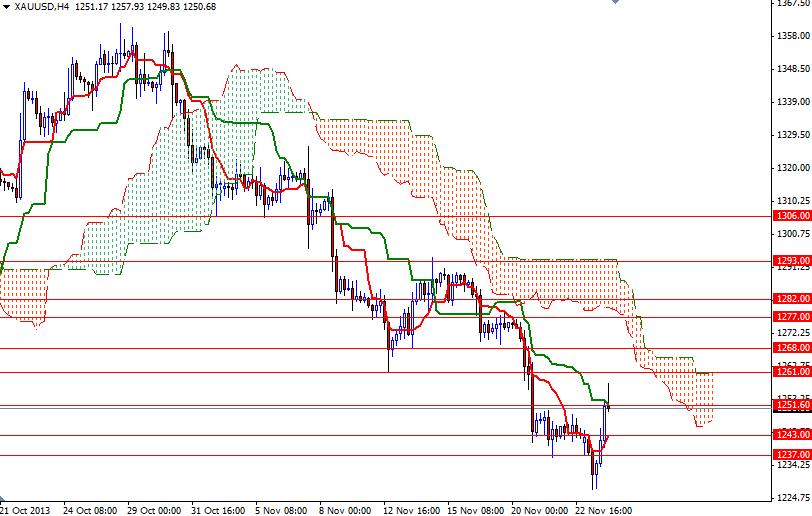

If the low prices attract more buyers and therefore help the bulls to defend the 1243 support level, it is entirely possible to see the pair extending its gains and moving towards the 1268 level. Ichimoku clouds represent resistance ahead of us and that means the bulls will have to push gold prices above this former support (now resistance) level in order to test the 1277 - 1282 area. To the downside, there will be support between 1243 and 1237. Only a daily close below the 1237 level might provide the bears the power they need to retest 1225.50.