The XAU/USD pair has declined approximately 25% since January 1 as investors' appetite for the precious metal continued to decrease drastically. The gold market is focused on the fact that the U.S. economy is steadily recovering. In conjunction with recent remarks from various members of the U.S. Federal Reserve, encouraging data have been reinforcing expectations that the central bank will begin trimming the pace of its purchases somewhat sooner than the market had initially thought.

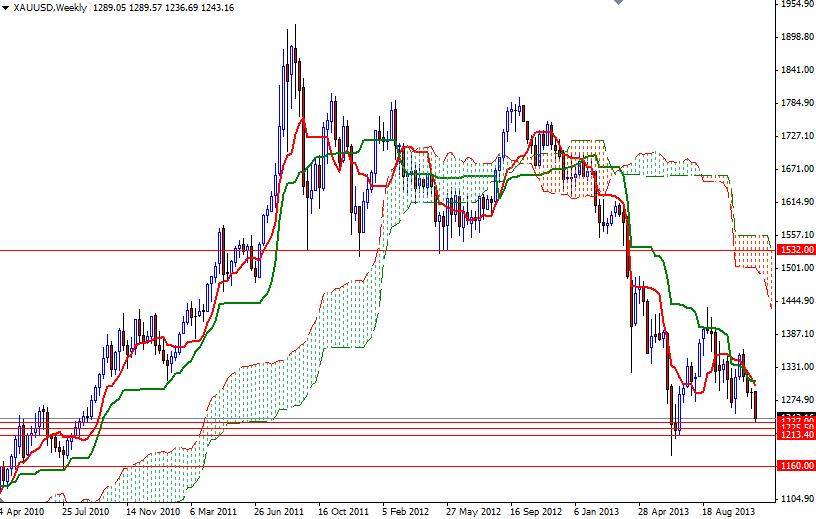

Friday's data from the Commodity Futures Trading Commission (CFTC) show that speculative investors on the Chicago Mercantile Exchange reduced their net-long position in gold to 48120 contracts, from 61352 a week earlier. In my previous analysis, I had mentioned that the path of least resistance for gold appears lower because the Ichimoku clouds have been blocking the bulls' advance.

Although the technical outlook (on the weekly and daily charts) remains extremely bearish, I will be paying close attention to the 1237 level in the near term. Usually, when an important support (or resistance) is broken, the market responds and retests it again before continuing the trend.

In other words, if the 1237 level acts as a bottom, it would be technically possible to see the market heading towards the 1268 level which helped the pair to reverse in the past. Of course, in order to approach that resistance level, the bulls have to gain enough strength to climb above 1252 and then 1261. To the downside, the bears will indeed need to break 1237 before they march towards the 1225.50 level. Breaching this level might confirm that selling could continue to the next support area between 1213 and 1200. Plenty of economic data is scheduled for the week ahead, including pending home sales, building permits, CB consumer confidence, durable goods orders and Chicago PMI.