By: DailyForex.com

The XAU/USD pair is trading in a relatively tight range during the Asian session today. Yesterday the pair tried to break below 1268 but more dovish comments from top Federal Reserve officials helped buyers to defend this support level. Federal Reserve Bank of Chicago President Charles Evans said “I am not in a hurry myself to reduce the flow of purchases. I’d rather wait just a little bit longer and have more confidence” and Federal Reserve Chairman Ben Bernanke reiterated the central bank will not change its highly accommodative policies until the outlook for the labor market has improved substantially.

Although weakness in the American dollar helped XAU/USD to pause its descent, the candlesticks show a real lack of momentum at the moment. The main event of the day will be the release of the minutes from the Federal Open Market Committee's October meeting. These records will provide some useful insight into what the voting members were thinking at that time. Investors will also pay close attention to retail sales, consumer price index and existing home sales data due later today.

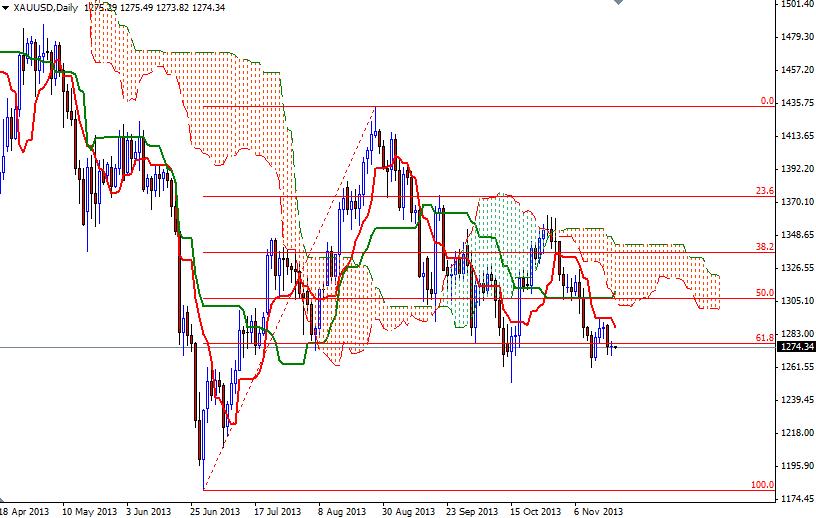

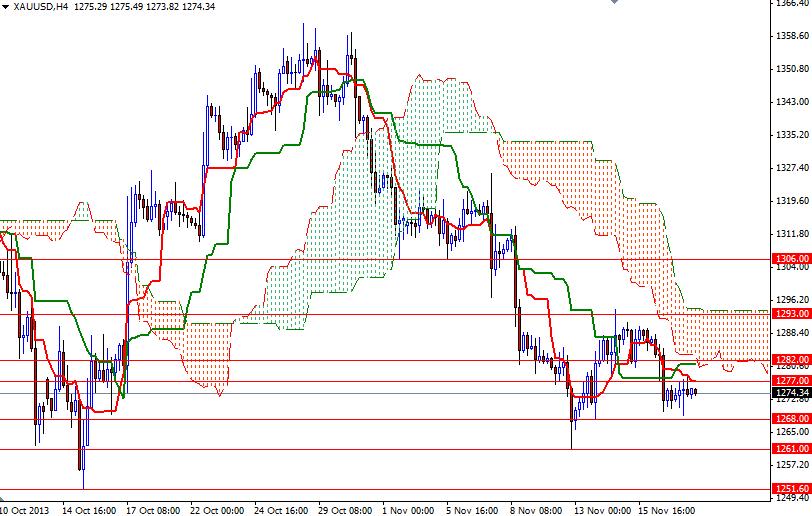

Technical formation on charts suggests the bearish pressure will increase if we close below the 1268/6 area. If that is the case, I will look for 1261 and 1251.60. If the bulls take over and prices start to rise, I will be focusing on the 1282 and 1293 levels which define the borders of the Ichimoku clouds on the 4-hour chart. I believe the 1293 level is a strategic point for the bulls to conquer in order to advance towards the 1306 resistance level. If the bulls manage to break through, it is likely that the pair will revisit the 1326 resistance level.