By: DailyForex.com

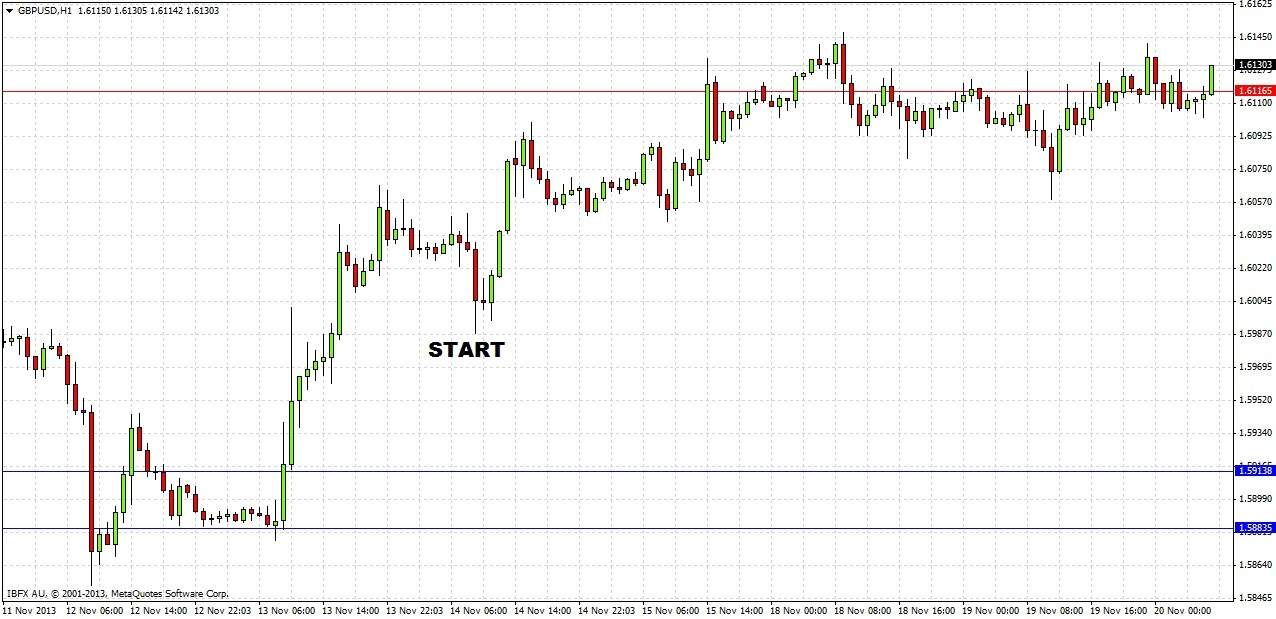

Last Thursday’s piece ended with only two predictions that are applicable to the price action that has taken place since then:

1. A break today of yesterday's high should see the price continue to rise close to 1.6115.

2. No overall directional bias, until there is a sustained break above 1.6250 (bullish) or below 1.5850 (bearish).

3. A sustained break of 1.6115 will be a mildly bullish sign.

To see how things have gone since then, let's take a look at the 1 hour chart below:

The predictions worked out perfectly. The previous day’s high was broken and the price reached 1.6115 the following day. Since then there has been little directional movement. The break of 1.6115 could be said to be sustained and has indeed led to mild bullishness.

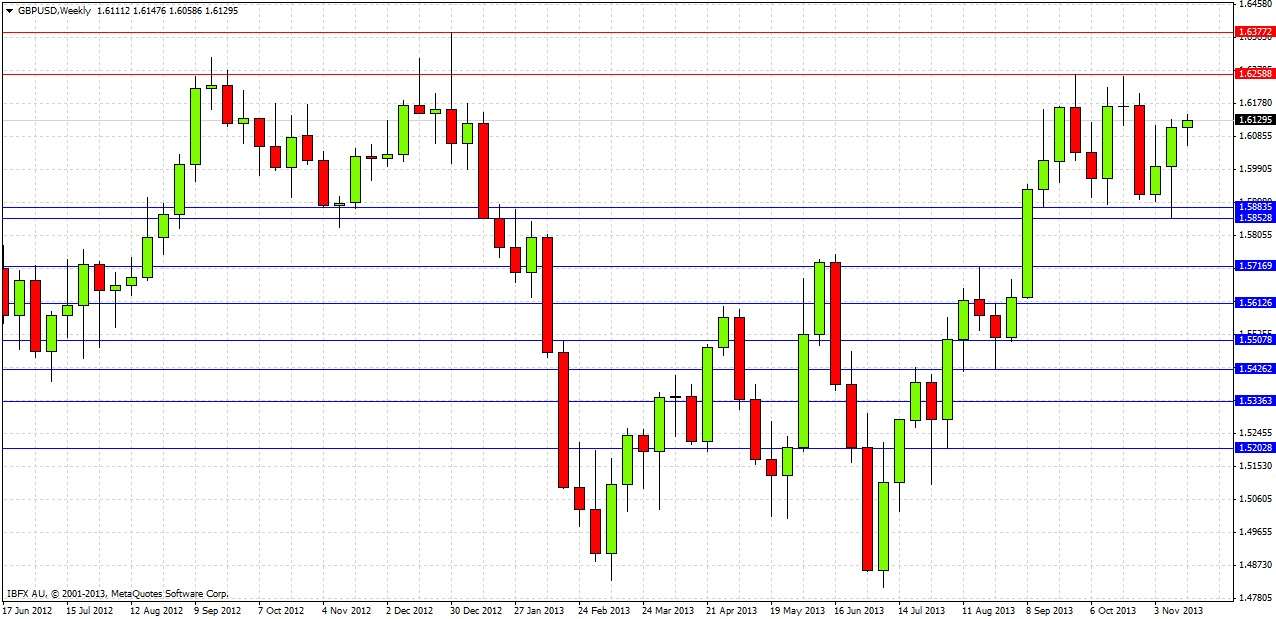

Looking to the future, let's start with the weekly chart:

Last week’s action is interesting. The price came down to the support zone, breaching 1.5583 and forming a new low just above 1.5850, before rising sharply. The pair closed the week near its high, printing a bullish outside reversal candle. The S/R level at 1.6115 has been sloshed around a fair bit over the last few days so can be said to have lost its significance. This is a bullish sign as long as the price stays above this level. So on this level, it is all bullish signals so far.

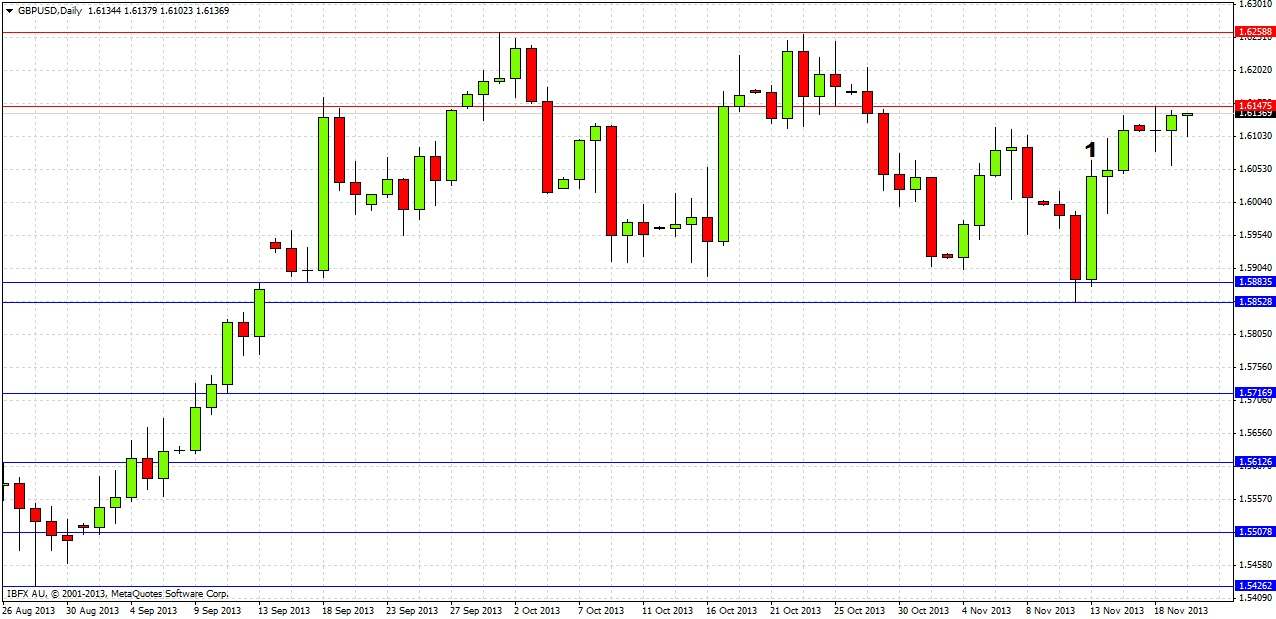

Turning now to the daily chart:

Last Wednesday printed a bullish reversal candle, as marked at (1) on the chart. Since then the action has been bullish, although yesterday printed the current weekly low. We can see a minor resistance level just ahead of us now at 1.6148 which is the current week’s high confluent with the overlap zone of the beginning of the last bearish break from the double top at around 1.6150.

It seems logical to stick with mostly the same conclusions as before:

1. No overall directional bias, until there is a sustained break above 1.6250 (bullish) or below 1.5850 (bearish).

2. A sustained break of 1.5850 to the downside should send price down to 1.5750 fairly quickly.

3. A sustained break of 1.6250 to the upside will have unpredictable consequences until 1.6377 is surpassed, which would be an extremely bullish sign.

4. A sustained break of 1.6150 would be a mildly bullish sign, but there is likely to be not much more room to move upwards so potential is likely to be limited.

5. If 1.6150 is not broken today, there is likely to be a bearish pullback. A good bearish reversal candle off 1.6145-50 could be a good short opportunity if there is momentum showing there. If 1.6250 is reached, this could also be another good short opportunity.