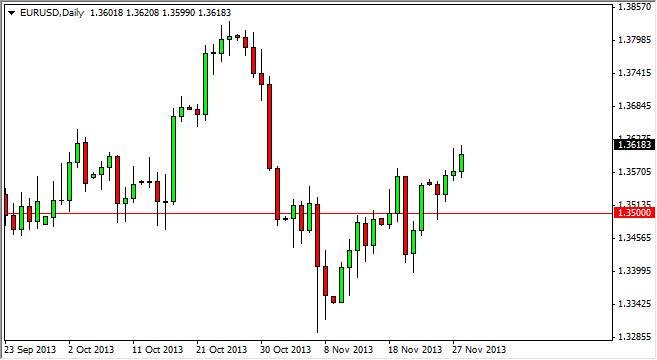

The EUR/USD pair rose during the session on Thursday, as the Americans were away on giving. However, you can see that the market did in fact get above the 1.36 handle at one point during the session, which of course was the level I needed to see this market break above in order to start going long. With that being the case, break of the highs from the session is more than enough of a reason to start buying the Euro again, as we should see this market continue to go as high as the 1.38 level.

This market breaking out to the upside is a little bit against what I believe, but at the end of the day. It doesn't matter what I believe, simply what the market does. As long as the Euro continues to strengthen, you cannot fight this move. I believe that the 1.38 level will be very resistive, but in the end, this is going to come down to the employment situation in the United States as far as I can tell.

Jobs numbers and the Federal Reserve.

Jobs numbers will be closely followed in the near-term, as the Federal Reserve and whether or not it can taper will come into play. The market will focus on whether or not that's a possibility, and as a result this could have wild applications when it comes to the US dollar. If for some reason, the market decided that the Federal Reserve was going to taper relatively soon, or if the Federal Reserve itself suggested this, this pair would absolutely collapse at that point.

The 1.3 level should be resistive enough to keep a little bit of a lid on the market though, and as a result I think this move is of the short-term nature at best. Expect more choppiness on the way out, that's essentially what this pair does from day to day. Pullbacks will more than likely offer buying opportunities, at least until we close below the 1.35 level, something that does not look likely to happen anytime soon.