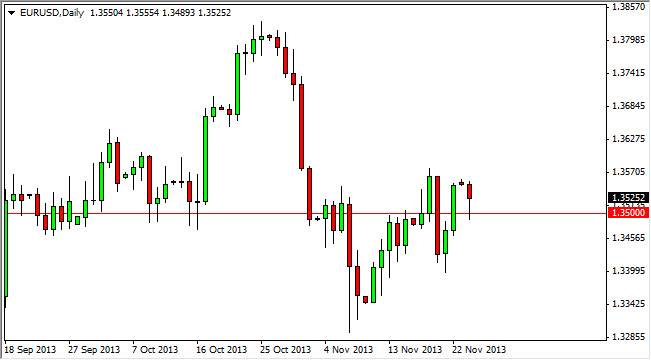

The EUR/USD pair initially spent most of the Monday session falling, but ended up bouncing off of the 1.35 level in order to form a hammer. The market saw the area as a “value” area, and as a result a lot of buyers came into the market to take advantage of possible support. In the end, they won the battle, but I see this market as one that could potentially be a bit range bound over time. The 1.33 level on the lower end has acted as support before, and the 1.36 level has been resistive in the past as well. I think this is the basic range we are looking at in the near-term.

The ECB and its surprise rate cut really threw this market into a fit. However, we have completely erased that sell off – or at least close enough to make it meaningless at this point in time. The area should attract a lot of action in general, as it has in the past. However, I think there is only one question that people are worried about at the moment….

The Federal Reserve and tapering…

I am bored with this. However, there are still questions about whether or not the Federal Reserve will be able to taper off of easing. If they can, this would crush the Euro. It isn’t necessarily anti-Euro so much as it is pro-Dollar. In that case, the two currencies are almost always diametrically opposed to each other, and as a result the EUR/USD would sell off.

Adding to that is the concerns about the European Union and its economy. The rate cut certainly suggests that there are underlying issues in this region, and of course that will always put a bit of fear into owning the Union’s currency. Even when the markets go higher, there will be an underlying suspicion about the actual health.

If we were to break above the 1.36 level, I would anticipate a move to the 1.38 level first, and then the 1.40 level. If we break the 1.33 level to the downside, the 1.30 level will be targeted. Until then, expect a lot of choppy behavior.