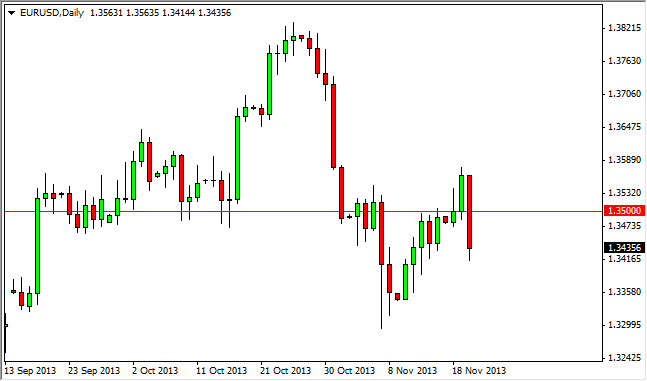

The EUR/USD pair fell hard during the session on Wednesday, slicing through the 1.35 handle as comments out of the European Central Bank suggested that a miniature rate cut could happen if the economy so warranted it. This got a lot of the buyers out of the market in a panic move, as the market fell all the way down to the 1.34 level. That being said, there is a bit of support below, so I think that all those sellers could continue to push the market lower, but in a choppy fashion.

I think that the market is heading to the 1.33 handle, but the real question is going to be whether or not it can break down through there. If we do see that happen, I expect see the 1.30 level tested alternately soon, where we will see significant support based upon longer timeframe charts. Until then though, you can count on this market being a bit choppy, and as a result only those who have the fortitude to hang on in volatile markets should be bothered.

Federal Reserve?

The Federal Reserve of course will have a certain amount of influence on this market as well, as traders will try to measure of whether or not they will be able to taper off of quantitative easing. If the jobs numbers coming out of America start to pick up, you can anticipate that this market will absolutely crater to the downside as this will have the Americans looking much more aggressive in their monetary policy then the Europeans.

On a break of the bottom of the range for the session on Wednesday, I believe that we do make that move down to 1.33 over the next couple of sessions. However, we may see another attempt to get above the 1.35 handle again, and if we do I believe that a resistive candle at higher levels is an even better trading opportunity, as it allows value to be found in the US dollar. Ultimately, I believe that this market will continue to be volatile, but with a negative bias at this point.