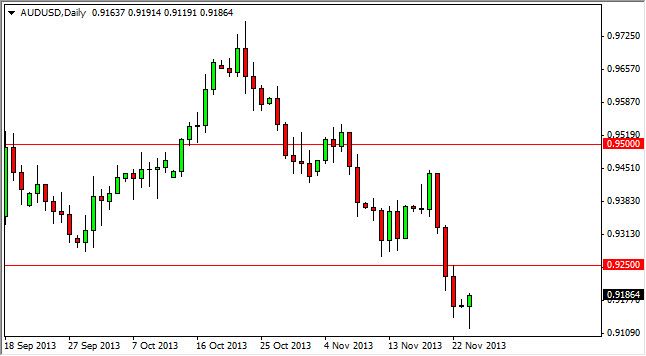

The AUD/USD pair spent most of the day on Monday, falling, but as you can see got a bit of a bounce above the 0.91 handle in order to form a hammer. In fact, as the markets are heading towards the end of the day, this hammer looks more and more impressive. However, I believe that ultimately this will be a little bit of a trap for those who are bullish of the Australian dollar.

The first thing that has me concerned is the fact that the 0.9250 level had been previously so supportive, and it should now be resistive. That area is just above the hammer, so although we could get a very quick short-term move to that level, I think that it would be much easier to simply wait until the market finds that level resistive enough to form a candle such as a shooting star, or even just a negative one in order to start selling this pair again.

Global growth and the Federal Reserve.

Remember, the Australian dollar is highly sensitive to global growth, especially coming out of Asia. Because of this, you have to pay attention to global growth numbers in order to decipher what the next move in the Australian dollar is going to be. Gold markets certainly won't be missed either, and you have to pay attention to what they are doing in order to understand was the Aussie mate the longer-term also.

The Federal Reserve and its tapering policy could also come into play here, as traders begin to wonder whether or not they can can't do so. If they do, expect the US dollar to become the most favored currency around the world suddenly. If that's the case, the Australian dollar will absolutely crumble at that point. This would be signified by a break of the bottom of the hammer, or perhaps that resistive candle near the 0.9250 level. I believe that ultimately the market believes in the Australian dollar going lower, so until proven otherwise, I will be very hesitant to start buying.