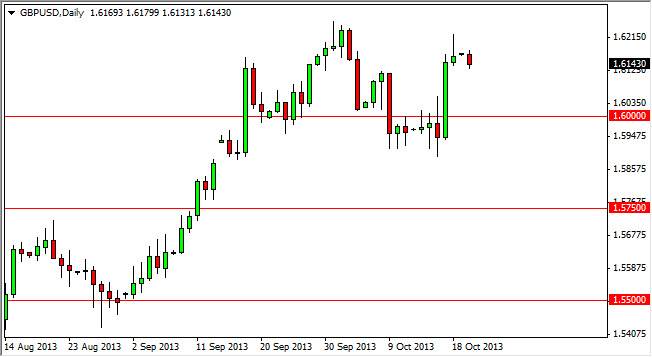

The GBP/USD pair fell during the session on Monday, breaking the bottom of the shooting star that had formed on Friday, which of course is a very bearish sign. However, I am not willing to sell this market as it is so well supported, and I believe that we are simply killing time going sideways after a very parabolic move higher. On top of that, you have to think about the fact that the nonfarm payroll numbers come out today, and this will have a massive effect on anything involving the US dollar.

With that in mind, I feel that a pullback will more than likely offer a buying opportunity somewhere closer to the 1.60 handle, an area that I think is rather supportive. That support extends all the way down to the 1.59 area where we have a nice gap from the beginning of September, and therefore I think it makes sense that if this market falls, we simply wait to buy some type of pullback that shows signs of support.

Jobs numbers out of America will determine the next move

The jobs number of course will determine the next move, simply because that is what the Federal Reserve is watching in order to decide whether or not to taper off of quantitative easing. If the jobs number is actually fairly strong, this pair could really fall apart and start diving deep at that point. However, I think that it's very unlikely and what is more likely is that we will break the top of the shooting star from Friday, which is reason enough for me to start buying this pair.

So having said all that, I believe that this is a "buy only" market at the moment, as we will either break the top of that shooting star, or pullback and find some type of support lower, possibly close to the 1.60 handle as it is a large round psychologically significant number, and there was a significant cluster there last week. Either way, I do not anticipate selling, unless of course the United States added something along the lines of 400,000 jobs last month, something that seems very unlikely.