The CAD/JPY pair is one that I like a lot. The spread is reasonable, normally something like 4 pips, and the fundamentals are relatively easy to understand. The Japanese have to import 100% of their oil, and the Canadians export a lot of it to the Japanese. Because of this, I prefer this pair as a proxy to oil more than the traditional USD/CAD trade. Besides, the Americans are becoming more and more self-sufficient when it comes to extracting oil, and with that – we could see a bit of a change in the behavior of the USD/CAD pair. The Japanese on the other hand don’t have that luxury.

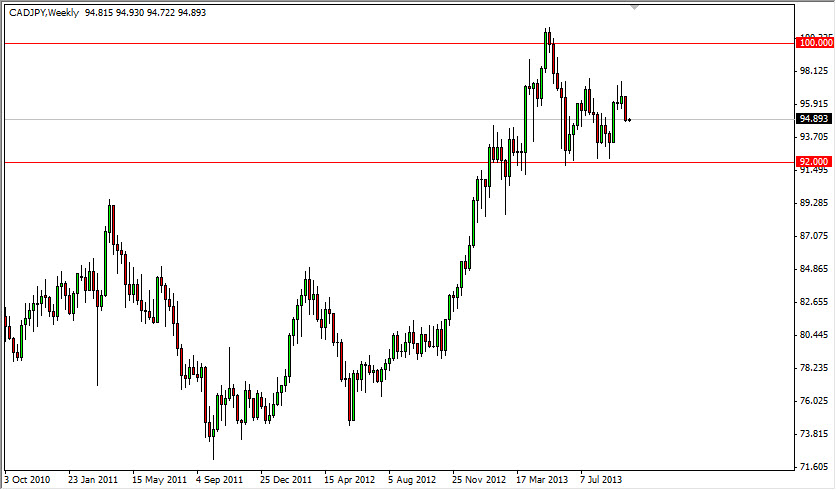

With this being said, we are starting to see both the CAD/JPY and the oil markets find support at the same time. Because of this, I expect the month of October to be good to this pair as oil bounces. Don’t get me wrong, I believe it will still be somewhat choppy, but there is a definite range that has formed, and because of this I think this pair will eventually find its way back to the 100 handle during the month.

Oil markets will push this pair, but the Bank of Japan can affect it as well.

The Bank of Japan cannot be forgotten either. After all, the Japanese are trying to bring down the value of the Yen, and this should continue to be seen in this pair as well. Between that and a possible bounce in the value of oil, I think this pair has a stronger than usual chance of bouncing in the near-term. The pair does tend to move in tandem with the USD/JPY pair, so watch that as well. (I believe it then becomes a North America vs. Japan issue.)

Going forward, I fully expect this pair to be the best way to play oil, and this will be especially true now that there is a bit of concern about the Federal Reserve choosing not to taper off of quantitative easing, and the confusion that caused. By playing this pair – you take the Dollar out of the equation.