EUR/USD

The pair fell during the week, but remains choppy to say the least. Although we broke below the 1.30

level, we didn’t do so significantly, and as a result it looks as if the market wants to chop around more.

The 1.28 level below should be supportive as well, and this means that even if we break down at this

point, it will be difficult for traders to justify the short position based upon risk-to-reward. For the

longer-term trader, this pair offers very little.

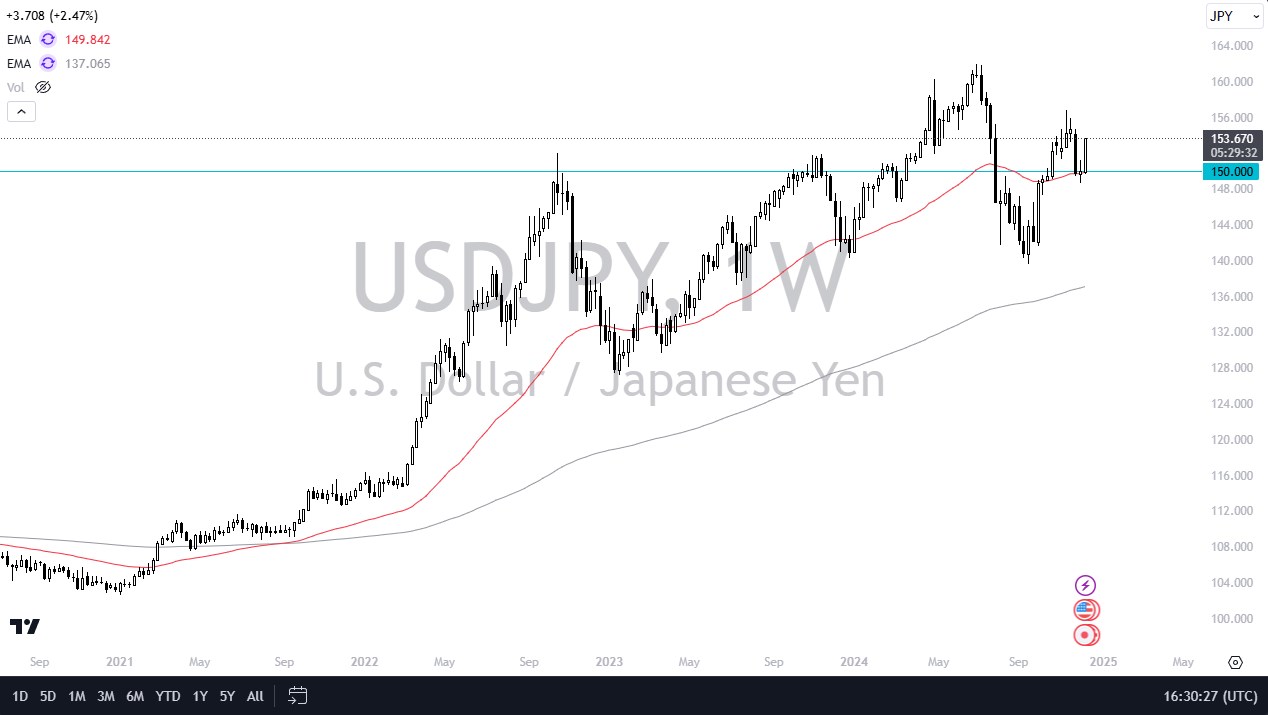

USD/JPY

The only real game in Forex at the moment is to sell the Yen. I know that a lot of newer traders don’t like

“following the herd”, but in reality there are reasons that the Yen is getting pummeled. This market is a

one-way trade, and only fools try to “outthink” the market in this kind of situation. As if you didn’t know

already, this market is a “buy the dip” kind of market, and as a result I will continue to be long of this

pair for the foreseeable future. In fact, I wouldn’t be surprised if I was still long this pair in 2014.

AUD/USD

The AUD/USD pair broke down during the week, but saw the week end above the important parity

level. This is significant, as the area has been important more than once. The gold market is certainly

not helping the Aussie at the moment, but the area we find ourselves in is strong. Also, even if we get

below this level on a break of the weekly candle to the downside, I see the 0.98 level offering even more

support. While I like shorting a breakdown – it’s a short-term trade at this point. Rallies will more than

likely offer selling opportunities as well.

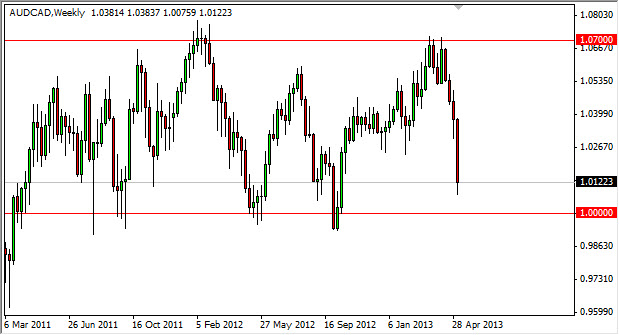

AUD/CAD

Although not necessarily a major pair, this market features two important currencies. This is going to be

particularly interesting at the moment as the commodity markets have taken a real beating lately, and

both of these currencies are so heavily intertwined with the commodity markets. Because of this, we

can spot the true strength and weaknesses of these currencies by watching this pair.

Looking forward, the 1.0000 level is just below, and an area where support will come into play. Because

of this, I think the Aussie may eventually do fairly well later in the week, not only in this pair, but in the

FX markets in general. However, if we break below it with conviction – this could be a very negative

signal for the Aussie overall.