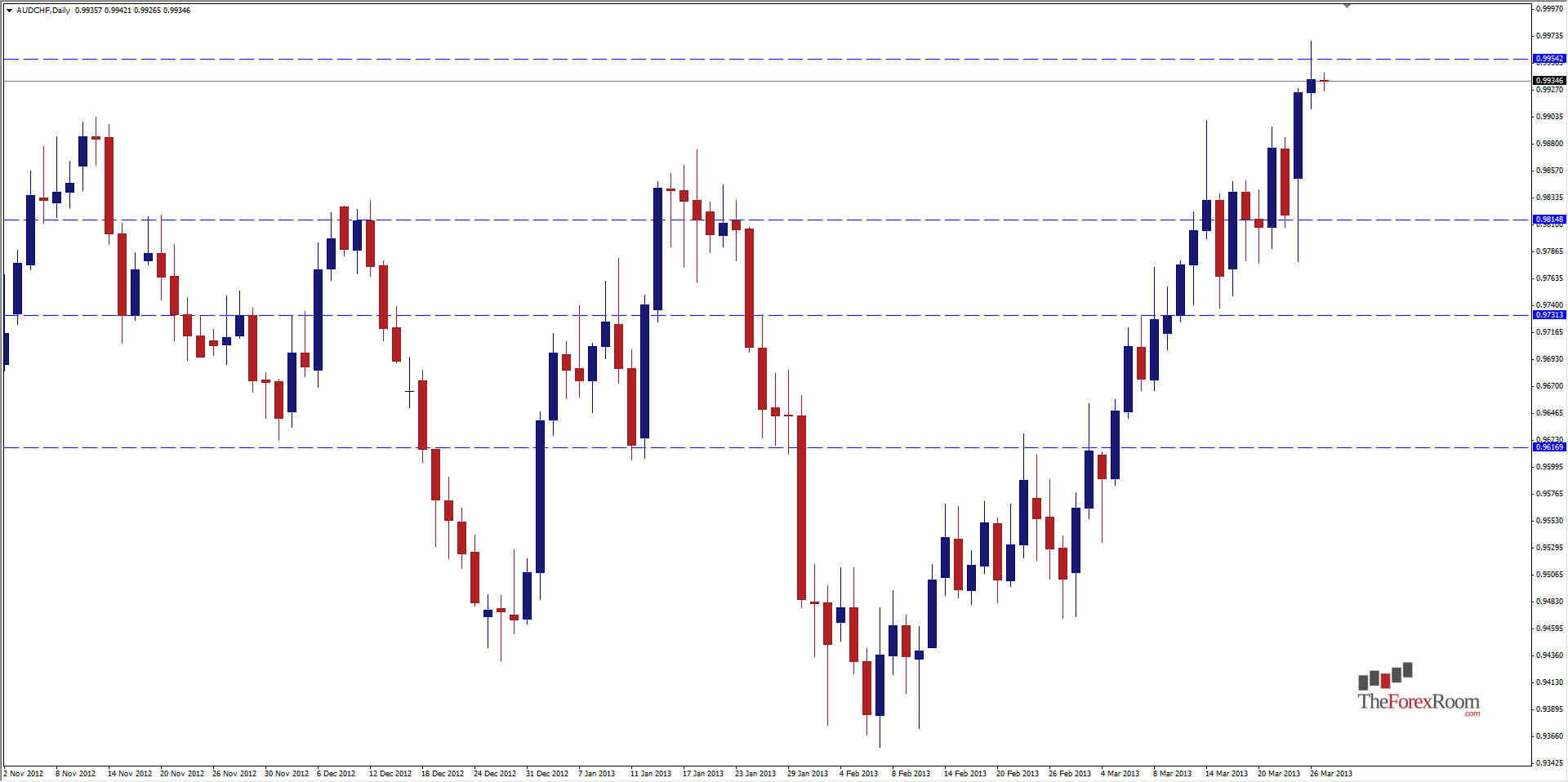

Yesterday the AUD/CHF climbed to a 7 month high, peaking at 0.9970 before falling to close at 0.9936, 14 pips under the monthly resistance level that restricted a further rise. As a results we had another Daily Pin Bar form, showing a rejection of higher prices, combined with a third level trend completion which could suggest a possible reversal, or at least a pullback / price correction before heading higher. Last week's highs are now support at 0.9896 but we could see prices fall back to the December highs at 0.9832. a 38.2 Fibo retracement for the up trend sits at 0.9750 and would be a likely candidate below 0.9830. The the upside we have further resistance at 1.0150 from the 2010 high before the July 2012 highs of 1.0348 come into play. There certainly is a strong case here for the bears to take some control, but there is also a well established up-trend that has lasted 2 months in place. Be cautious if you are shorting this pair.

AUD/CHF Hits 7 Month High

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown....

Read more Subscribe Sign up to get the latest market updates and free signals directly to your inbox. *By registering you agree to receive communications.

Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

- Labels

- AUD/CHF