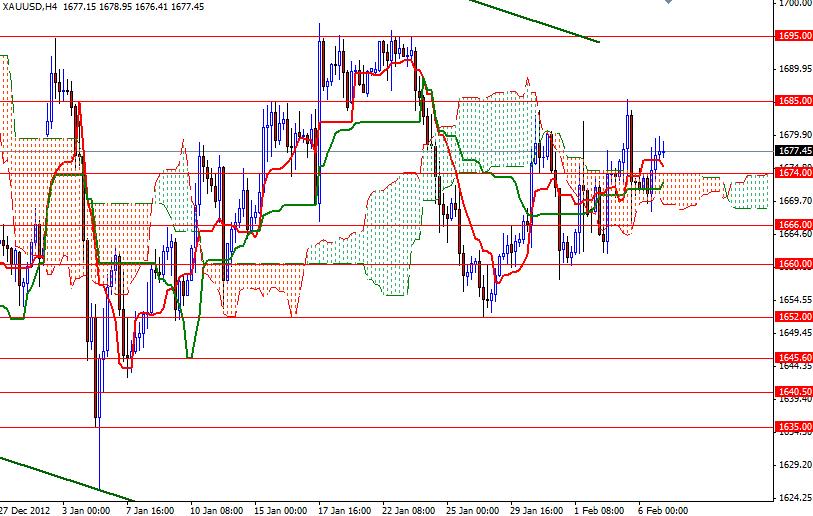

The XAU/USD pair (Gold vs. the Greenback) rose yesterday as renewed fears about the U.S. debt ceiling and long-term spending cuts weighed on the greenback. Republicans are increasing pressure on Democrats to come up with a plan to replace the spending cuts. House Speaker John Boehner said “At some point, Washington has to deal with its spending problem. I’ve watched them kick this can down the road for 22 years that I’ve been here. I’ve had enough of it. It’s time to act”. The federal government has to find a comprehensive solution to reduce the budget deficit to prevent an economic catastrophe. It seems that the level of uncertainty in the U.S. is contributing to higher gold prices. Yesterday, the XAU/USD pair found support and bounced off of the 1668 level and also managed to hold above the 1674 resistance level. The 4-hour chart is bullish at the moment; prices pushed through the Ichimoku cloud and the Tenkan-sen line (nine-period moving average, red line) is above the Kijun-sen line (twenty six-day moving average, green line).

However, the pair still faces an interim resistance at 1679 and a major resistance (the top of the descending channel) at 1685. If we continue to trade above the 1674 level, I believe the bulls will make another attempt to climb above 1685-1688 zone. Beyond this zone, there is a critical resistance level at 1695. A close above this level would turn the daily chart strongly bullish. Support to the downside can be found at 1668/6 and 1660. If the bears successfully push the pair below 1660, I think speculative selling pressure will increase and we will retest the 1652 support in a short time. Today the eyes will be on the eurozone as ECB President Draghi's press conference is the main event of the day.