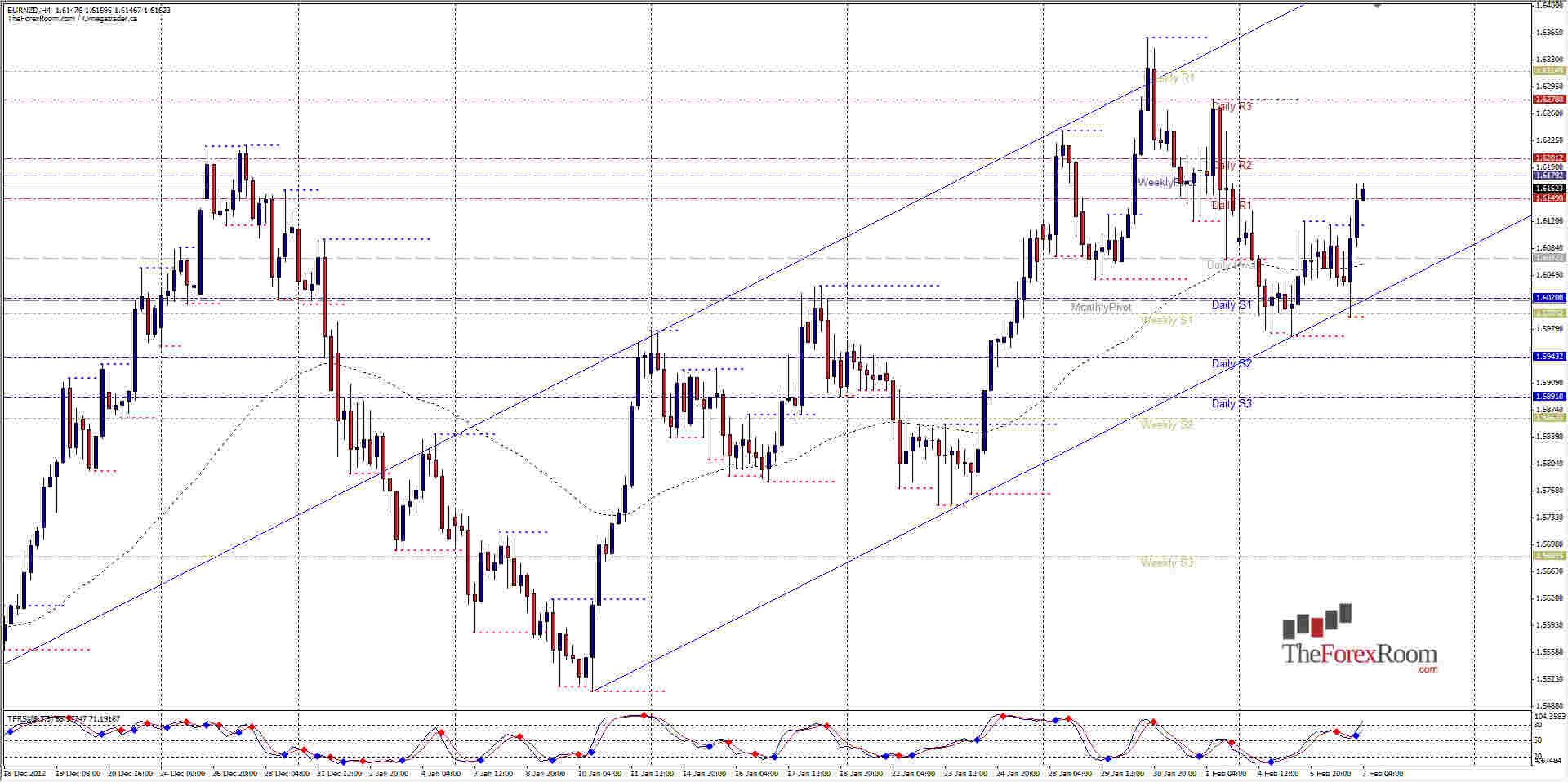

The EUR/NZD has been trading in an upward channel since hitting 1.5507 on January 10 of this year. Since then the pair has been providing some nice trading opportunities on the 4 hour charts and today is no exception. The pair reached a low early in the Asian session of 1.5995 where it reversed on mixed employment numbers from New Zealand as the Kiwi fell. in value against the major's including the EURO. The pair is currently trading at the mid point of the rising channel and just below the Weekly pivot at 1.6179 with further resistance above from the Daily R2 at 1.6200 and 1.6278 where the Daily R3 joins the February 01 high. If the goal is the top of the channel, then there is a good possibility that we could see the pair reach 1.6400 and fall once again if the channel holds. If not, the next target will be the October 2011 lows at 1.6497. If prices reverse, and they might considering last week we printed a bearish Pin Bar off of the December 2012 high at 1.6219, support will be a factor at 1.6120, then the Daily pivot at 1.6070 and the bottom of the channel/daily S1/Monthly Pivot all meet at 1.6015-1.6020. Below 1.6000 the high from December 12 at 1.5927 will pave the way to a lower push to 1.5863 where the Weekly S2 and Daily 62EMA meet.

EUR/NZD Honors Channel- Feb. 7, 2013

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown....

Read more Subscribe Sign up to get the latest market updates and free signals directly to your inbox. *By registering you agree to receive communications.

Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

- Labels

- EUR/NZD