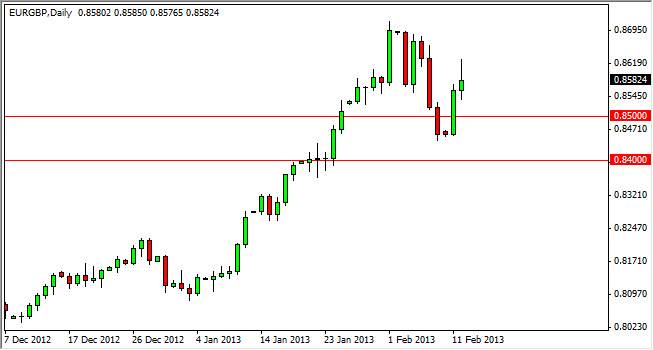

The EUR/GBP pair initially surged during the Tuesday session, but found the 0.86 level as being far too resistive to overcome. Because of this, we saw significant pullback and a shooting star form that was essentially perfect and its shape. With that being said, it looks like we may get above a pullback in this market, but there are a few different things that have me concerned about taking this trade.

I think eventually we will see a retest of the support "zone" that we bounced from 48 hours ago. The 0.84 to the 0.85 level offers 100 pips of support in this market that I think will be difficult to overcome. That being said, it should be noted that the British pound formed a wicked looking hammer the look very bullish against the US dollar on Tuesday, normally a harbinger of British pound strength. If that's the case, then this pair very well could pullback in sympathy.

Having said that, the Euro does look fairly strong against the Dollar as well. This is why I think this pair will essentially pullback, but not meltdown. Both currencies are strong, and although the Pound looks like it's about to make a more serious move in the short term, long term charts certainly favor the Euro. This is why this pullback will be relatively short, and find support just below in order to bounce higher.

0.87

Above that the 0.87 handle, I see a significant amount resistance but an area that will eventually give way to the buyers. After all, all is well in Europe now and the debt crisis has been solved. (This of course is me being sarcastic, but it seems to be the way the markets one function.) It really doesn't matter what's correct, just that the markets seemed think that the European Union has fixed its problems, or at least done enough to waylay a lot of the fear that has been out there. Remember, markets trade on sentiment more than anything else, and this chart is a perfect example of that. With that being said, I will be buying the pullback as soon as I see signs of support in that zone.