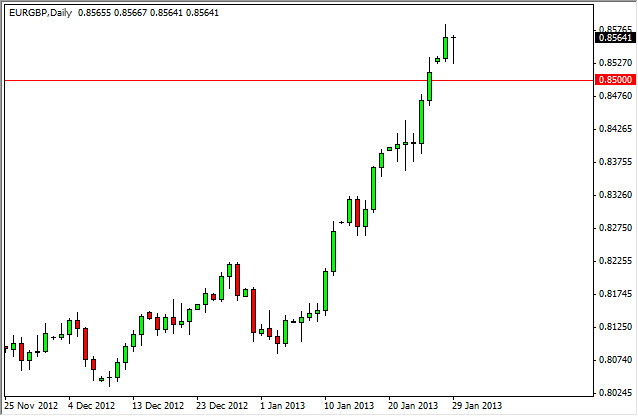

The EUR/GBP pair fell during the session on Tuesday, but did bounce just above the 0.85 level in order to form a hammer. This hammer suggests to me that we are going higher in this pair, and quite frankly the Euro seems to be picking up steam against everything at the moment. This is more than likely a result of the ECB and its unwillingness to participate in the "race to the bottom" that we are seeing around the world.

Looking at this chart, it appears to me that the 0.84 level is the real "floor" in the market at the moment, and as a result even if we do fall from here, I expect that we will see support going forward. While I see that the British pound is doing better in general over the last 24 hours, I think that it is still going to be weaker than the Euro going forward. Because of that, we should see this pair drift higher. However, I would expect that the rate of acceleration slows down, which quite frankly has been far too strong and parabolic for my liking anyway.

Triple dip recession

There are a lot of fears about a British "triple dip recession" coming this year. Quite frankly, that doesn't concern me and I couldn't care less. However, I do recognize the fact that this makes the Pound much less attractive than the Euro going forward. I still believe that the Pound will be body in general, basically because we should see a "risk on" rally this year. Because of this scenario, I believe that this pair goes higher, but as I said above I don't think it will be as parabolic as we've seen.

Also, it must be said that the markets are forward-looking and it is only a matter of time before start pricing in a British recovery. Because of this, the rally will certainly meet headwinds from time to time, and I do think that this pair will be a grinder, rather than a runner. With that being the case, if I was forced to trade this pair I would buy it, but quite frankly they're always going to be better opportunities in the Euro against other currencies.