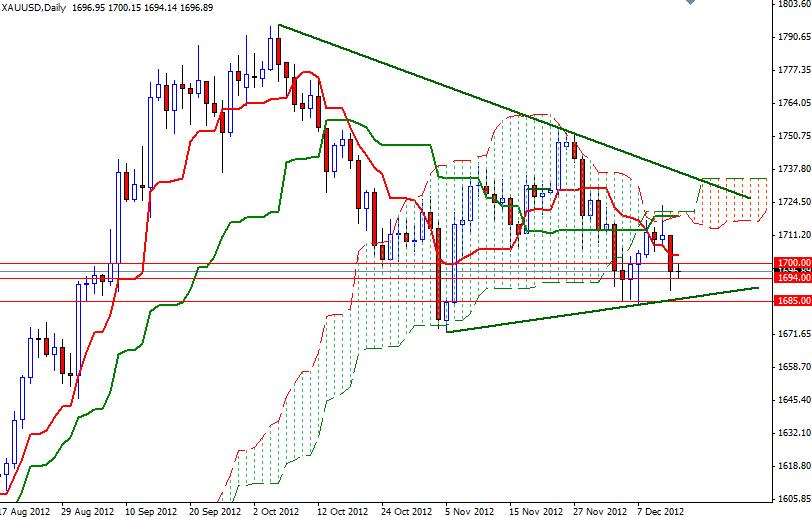

The gold market appears to be stable with the bulls and bears gaining and losing ground almost equally during the Asian session. Right now the battle continues to intensify in the 1700-1694 zone. The adrenalin rush of a decision by the Federal Reserve to implement further asset purchases wore off as investors prefer watching things from the sidelines for the time being. Although several central banks around the world (including the Fed) continue to ease monetary policy, the market still faces various uncertainties. Concerns over the ongoing budget negotiations in the United States, political turmoil in Italy and eurozone’s deepening recession are the most important elements affecting the market. Pattern on the daily chart suggests that prices will continue to remain under the bearish pressure. On the daily time frame, we have a bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen line (twenty six-day moving average, green line) cross and prices are well below the Ichimoku cloud.

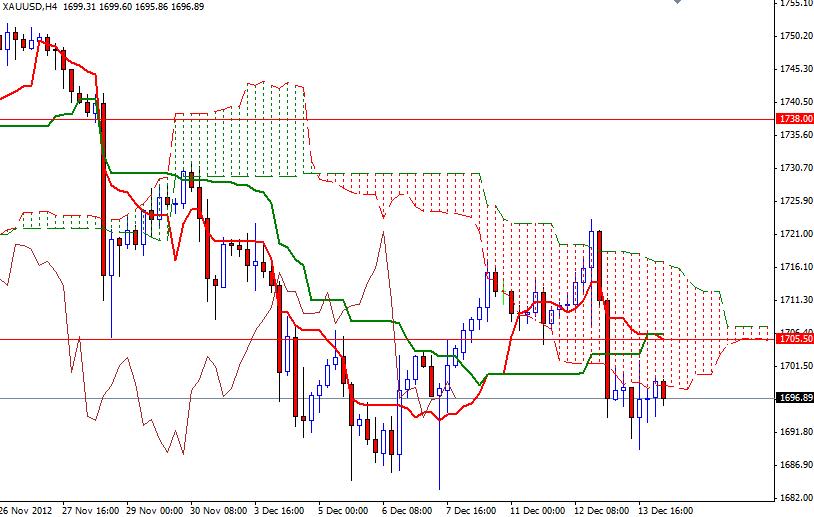

I see XAU/USD is trying to form a bottom on the 4-hour chart but the bears are defending the 1700 level so far. The bulls will have to break through the 1705/1707 zone in order to gain some momentum. If they manage to hold above 1707, expect to see more resistance at 1712.60, 1716 and 1723. If the floor (1694) is breached, look for 1689, 1685 and 1676.76.