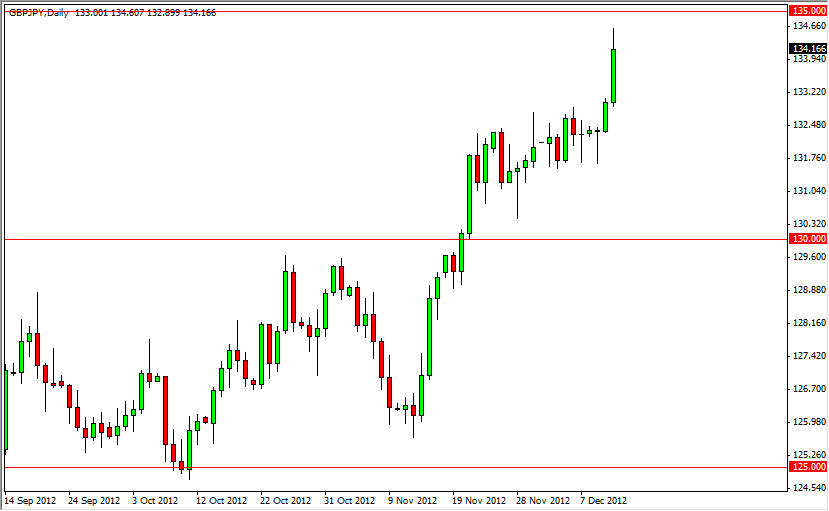

The GBP/JPY pair had an outstanding session on Wednesday as the market skyrocketed towards the 135 handle. However, we could not break that level, and as a result we did selloff a little bit towards the end of the day. Nonetheless, this does look like a very strong move waiting to happen.

Having said that, it does look like a pullback could be coming, but it also looks like the 133 handle should now be support in this marketplace. 135 is an obvious resistance point in this pair, so it would make sense that we would have see the market come back to find more buyers to create the momentum to go higher overall.

You have to remember that this pair is highly sensitive to risk appetite, and the Federal Reserve expanding its buyback program as well as other purchase programs during the session on Wednesday certainly would have put a bit of a "risk on" type of field to financial markets in general. When this happens, this pair will move higher.

135 and 133 are crucial

The 135 level as mentioned above is massively resistive, and a breakout above that level would be a very strong sign for this market. I believe that if we managed to get above that area, this market would then find it as a floor going forward. However, it's just as likely and possibly even more so, that the market pulls back to the 133 level. If that's the case, I would be more than willing to go long of this pair based upon some type of supportive candle in that general vicinity. In fact, I would be willing to do it off a short-term candle as well like a 30 min. hammer or something of that ilk.

As far as selling is concerned, we would have to break down below the 130 level with some type of significance for me to even consider it. I believe that the Yen will continue to weaken against many of the world currencies going forward and if that's the case this pair should do quite well over the long run. After all, the British pound is doing well against the Dollar also, so it seems that there is a bit of Pound strength overall.