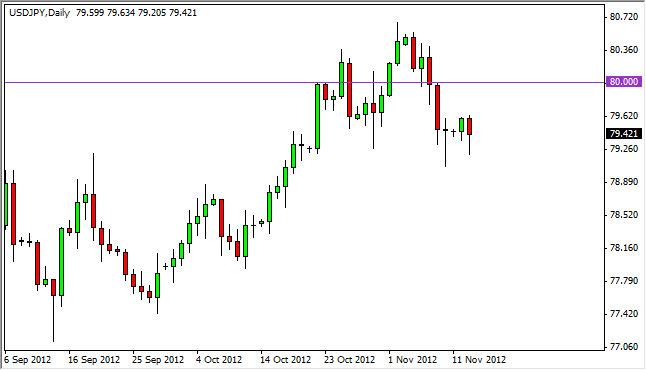

The USD/JPY pair continues to do very little during the session on Tuesday, as the 79 handle offers significant support. This market has been manipulated for some time now, but this doesn't mean that we can't as small time retail traders take advantage of what the larger forces in the markets are doing.

I see the 79 handle as a significant "floor" in the market at the moment, but I also see the 80.50 level as an area that the buyers simply cannot get over. With this in mind, and the fact that we have formed two hammers out of the last three trading days, I firmly believe that we are breaking to the upside in the near-term. On a break above the Monday and Tuesday highs, I would be very comfortable going long of this pair, but only for a short-term trade.

Smash and grab

This is almost like a "smash and grab" type of trade. We simply will try to take advantage of a consolidation move that's in the relatively tight range. The reason why I am so interested in buying, and not so much in selling is the fact that the Bank of Japan could get involved in the market either verbally or through some type of asset purchase at any given moment. This being the case, it's much safer to buying this market.

Granted, the Federal Reserve is working against the value US dollar, but it isn't as overly concerned about this market as it would be against the Euro. Because of this, I think this market as more of an upward bias over the longer-term. However, I do not see the catalyst at this point in time to see this market skyrocket. With this in mind, I fully expect this to continue consolidating for the foreseeable future.

If we were to managed a breakout above the 80.50 level, I think that the 84 level would be targeted shortly afterwards. At that point in time, a move above that resistance level would make this a long-term buy-and-hold situation. As far as selling is concerned, with the Bank of Japan out there lurking, I'm just simply not willing to risk it.