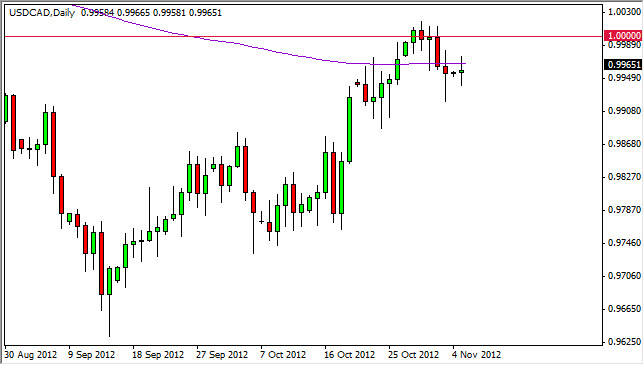

The USD/CAD pair had a relatively back and forth session with a slight gain on Monday. As you can see by the chart, we hovered just below the 200 day exponential moving average, and are above the 0.99 support level. This makes perfect sense to me, as the US Presidential election is today. These two economies are very intertwined, and what happens in America certainly has a massive impact on what happens in Canada.

The election will provide direction for the US dollar going forward. If we continue with a president Obama, one would have to think that the easy dollar policy would continue. However, his opponent Gov. Romney is the exact polar opposite. Because of this, we will certainly see a US dollar rally, and this could kick off a return to the previous consolidation area.

The previous consolidation area was between the 0.99 level, and the 1.04 handle. I believe that a Romney victory will put that into play, and a break of the recent highs at roughly 1.00250 would be the signal to start buying.

Parity is the Gateway

If we can get above parity, I truly believe that this market will continue to rise in value. The 200 day moving average is one that is favored by a lot of longer-term traders, and as such this would bring in the "big money" as well. The moves will be choppy and will certainly run into resistance from time to time, as is the norm of this pair. This makes sense, as the two economies are so intertwined; it's hard to get one leaning in a particular direction while the other one falls apart.

The oil markets will of course have an effect on this currency pair as well. Because of this, you have to pay attention to what's going on in the crude markets. If a Romney win brings in a stronger US dollar, oil prices will collapse. In fact, one has to think that a huge part of the oil rally over the last year or two has been due to quantitative easing. Because of this, this is another bellwether currency pair that will be interesting to watch at the end of the day. If Obama wins, a break of the 0.99 level will more than likely have this pair testing the 0.97 level again.