The USD/CAD had an odd day on Friday. There was both a US jobs number, and a Canadian one. The US jobs number came out much stronger than expected, while the Canadian one came out weaker than expected. Because of this, there would've been mass confusion in this currency pair.

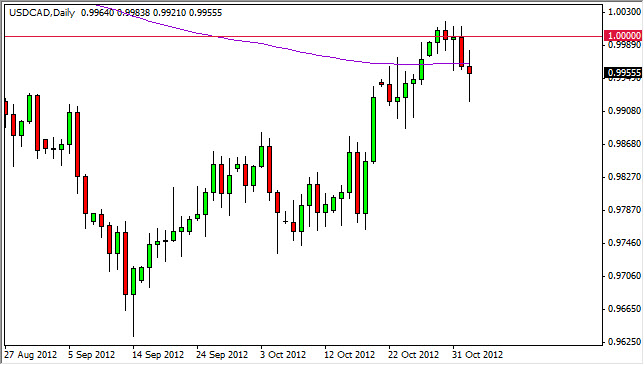

As you can see by the chart, there is a purple moving average that is plotted. This is the 200 day exponential moving average; as you can see we are sitting just about have any level. A lot of traders will of notices, it cannot be helped but saying that the pair did get a nice bounce towards the end of the session. The candle of course looks a bit like a hammer, and the fact that we are sitting above the 0.99 support level still leads credence to the idea that this pair could be going higher.

The simple analysis is to wait for a new high to form, and then start buying this pair. If that happens, I believe that we will reach the top of the previous consolidation area at the 1.04 level. This of course makes sense if the Canadian economy is weakening while the US, and he is releasing stable.

With the recent fall in the price of crude oil, this move makes complete sense to me. However, I am willing to admit that this is a countertrend move, and as such I would be willing to get out of that at 1.04 if I get the buy signal. As far as selling is concerned, a break of the 0.99 handle would more than likely be enough to have me flip my position and start going short.

Election

The importance of the Tuesday presidential election in the United States cannot be overstated. This pair should be an interesting one to watch as Gov. Romney is well-known for his pro-energy platform, and the desire to drill inside the United States. Also, if the United States is going to develop a firmer monetary stance, this could push prices higher in this currency pair, while pushing the price of oil lower on various fronts. Because of this, if Romney wins the election on Tuesday I believe this pair will indeed run back to the 1.04 level. A simple technical trigger would be to wait for a new high to form and simply buy at that point.