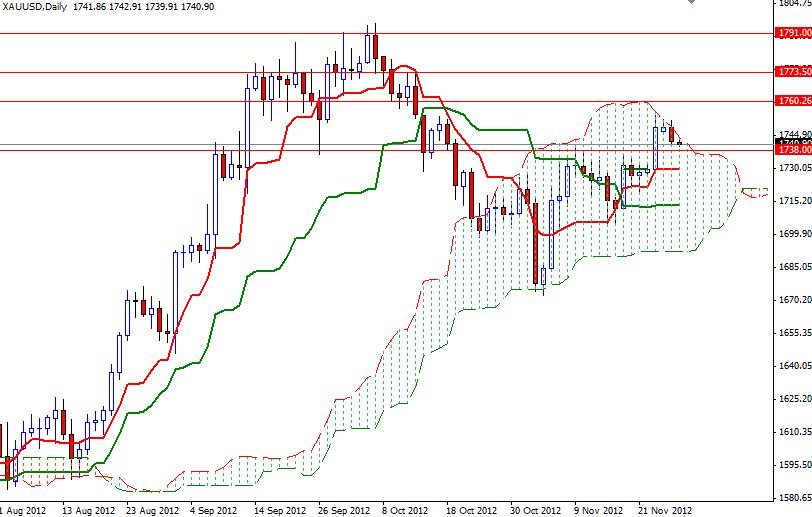

Gloomy situation in Europe and optimism that the Democrats and Republicans can reach an agreement on the U.S. budget boosted the greenbacks safe-haven appeal. As the weak attempts failed to climb above the Ichimoku cloud (the daily chart) earlier this week, the pair tested the 1738 support yesterday and the selling pressure increased after XAU/USD broke below this critical support level. This level was also the bottom line of a wedge formation. I think the reason behind this sell-off was mostly based on technical selling. On the daily time frame, this reaction makes sense. Prices have been bouncing between the first line of the cloud (known as Senkou Span A) and the second line of the cloud (known as Senkou Span B) since October 24.

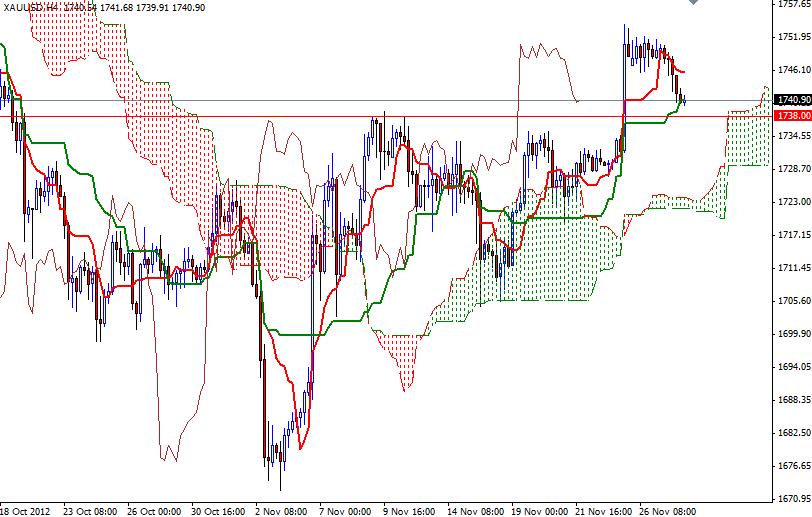

On the 4 hour time frame, Tenkan-sen line (nine-period moving average, red line) crossed below the Kijun-sen line (twenty six-day moving average, green line) and prices fell below the cloud, indicates that the bears are fighting hard to take over. However, the pair found strong support at the 1705.50 area and bounced back to 1720. This shows XAU/USD is going to be range bound. If the bearish sentiment continues, I believe we will retest 1713. If the bears manage to breach this level, look for 1710.30, 1705.50 and 1692. If XAU/USD turns bullish and start to rise, the bears will be waiting at 1725.50, 1729.49 and 1738.