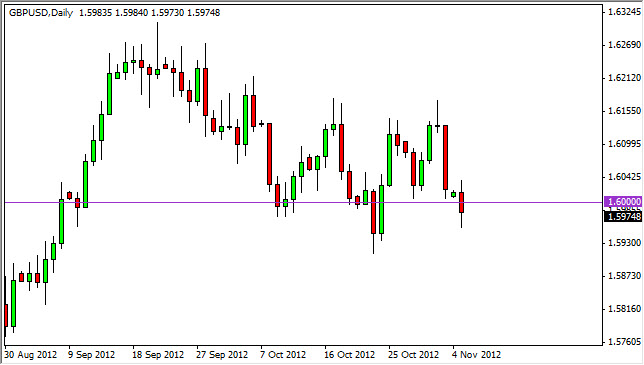

The GBP/USD pair fell during the session on Monday as we peeked back down below the 1.60 level. Looking at this pair, you can see that has been quite a fight lately and it does seem to be centered on some type of support zone at the 1.60 level. With this in mind, I am still bullish of this pair, but just barely at this point.

The Bank of England has recently stated that it was relatively comfortable with its monetary policy while the Federal Reserve has suggested easing is the only thing that we will be seen for years to come. This of course has gotten complicated by the fact that the presidential election is so close United States, and perhaps that is part of what's going on in this currency chart. Because of this, I think although this will be one of the least affected currency pairs due to the presidential elections, there certainly should be some type of affect at the end of the day.

I still see the lows that we had a couple of weeks ago at the 1.59 handle as being significant and what is needed to be validated in order to start buying again. On a supportive candle, I would be interested in going long of this pair. However, if we break below the 1.59 level, I think this pair could drop the 1.57 in relatively short order.

Rounded bottom?

The pattern right now does look like it's trying to form some type of rounded bottom. However, if we managed to break down below the 1.59 level it completely invalidates everything and really has the market confused and probably negatively biased at that point. If we can get below the 1.57 level, this pair would absolutely implode.

Alternately, if we can get some type of supportive candle I would be willing to buy at this general area. I do see the 1.62 level as being extremely resistive, and as such we could simply returns to the recent consolidation between 1.59 and 1.62 or so. If that's the case, I will simply employee a range bound type of strategy based upon shorter time frames.

We have broken the top of an ascending triangle at the end of the summer, and this pair looked really healthy at that point. However, the last couple weeks have had me doubting this pair, and now I think we are simply waiting on the election.