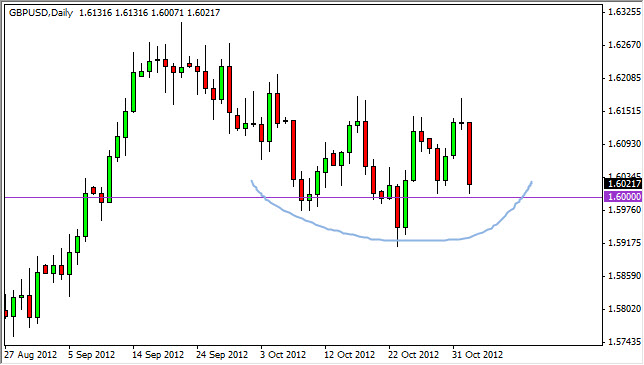

The GBP/USD pair had a very weak session during the Friday trading hours, as would have been suggested by the shooting star that we had formed on Thursday. If you remember correctly, I had written that a break of the lows from Thursday could send sellers aiming for the 1.60 level. That level has held as support so far, and it makes sense as it is a large round psychologically significant number.

However, the candle did close towards the very bottom of the range, and we closed just 21 pips above the 1.60 level. This suggests to me that perhaps we could continue lower, but I cannot help but notice that this area seems to be forming a little bit of a rounded bottom. If that's the case, we should not make a new low and form some type of supportive candle in the immediate vicinity.

1.60 / 1.59

The 1.06 level appears to be supportive, and of course a lot of traders will be aiming for in both directions. If we can stay above the previous low, which is roughly at the 1.59 level we should continue higher. After all, the Federal Reserve is in a printing mood, while the Bank of England has stated that it's perfectly happy with its monetary policy. However, it should be stated that there have been some cracks in that story lately, and a few members have suggested that perhaps something needs to be done. If that's the case, this pair will certainly fall.

As I have stated in my other articles for today, you have to keep an eye on the presidential election on Tuesday out of the United States. A Gov. Romney win would be pro-dollar and should send the currency higher in value. If that's the case, this pair will fall as he is seen as more of a hawk than a dove. If Obama wins, then we should see continuation of the US dollars weakening, and as such this pair should continue to rise. Either way, we have a couple of obvious technical areas that we can play for supportive bounce, as I believe the longer-term trend is certainly to the upside.