The EUR/JPY pair continued to grind away at the 103 level during the session on Tuesday in order to try and continue upward momentum. The initial move for the session was to fall below, but a later day surge higher signaled that the 103 level was continuing to support the markets. The pair seems to be waiting for something to kick start the risk appetite in general, and with the Presidential elections going on in the United States during the session, this very well could be it.

The pair has a history of following risk appetite, and also has the added weight of Bank of Japan monetary actions. After all, the BoJ has been working very hard to bring down the value of the Yen against almost all currencies, and this includes the Euro as well.

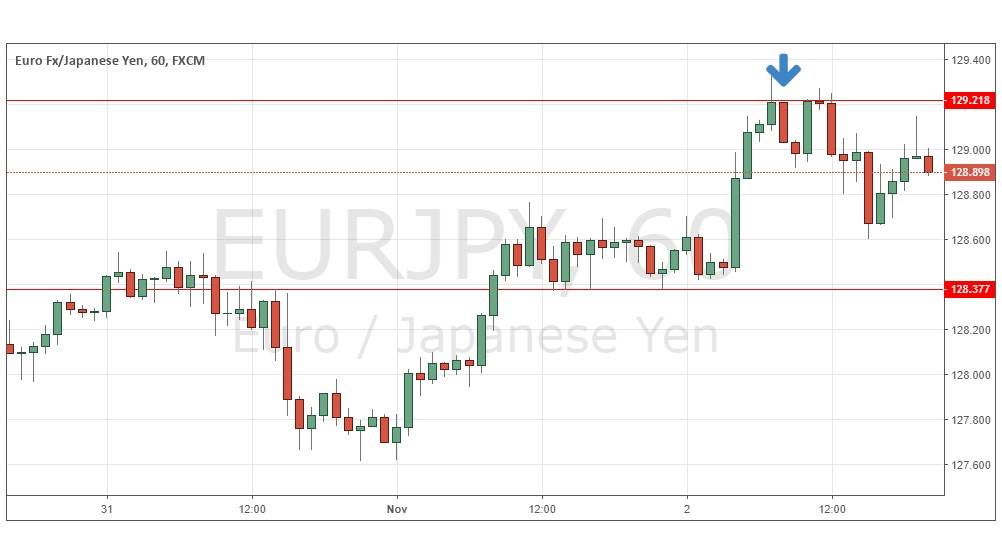

The pair has a solid support base in this vicinity all the way down to the 102 level. If this level gives way to the sellers, this pair could really accelerate to the downside. This pair could also be the bell weather as to where other markets go as well. The reaction will more than likely appear during European trading. The markets could also be defined when the Americans come back online.

Divided?

If the elections show that the US is still divided as far as government is concerned – we could be racing towards the fiscal cliff. There is very little to suggest that the groups of government in America have any interest in working together, so there will be a real chance of a major “risk off” move soon. Because of this, even if we get a surge, I will be cautious going forward.

The recent action does however suggest that the path of least resistance is higher. Because of this, there is a real chance that we revisit the 105 handle before it is all said and done. The breaking of the top of the Tuesday candle would open up the possibility of such a move. However, I will be taking that trade with tight stops as it is only a matter of time before someone asks: “What now?”