By: DailyForex.com

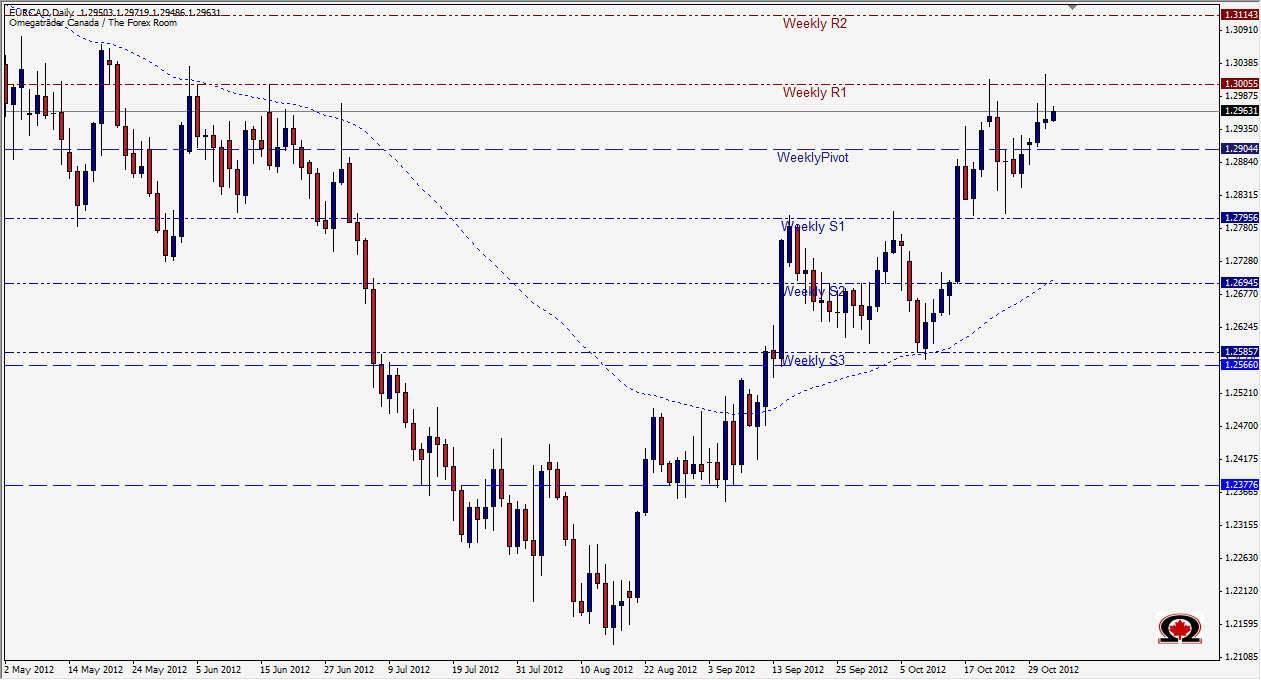

The EUR/CAD has printed a double top on the Daily Chart at a key resistance level of 1.3000. 9 days ago the pair reached a high of 1.30131 before falling about 130 pips from a daily pin bar. This time, we have another pin bar with a high of only 9 pips higher at 1.30221 and the potential for a bearish reversal is even stronger. Support is plentiful below the current price or 1.29661 less than 45 minutes before the London markets open and could certainly impede the bears progress if yesterday's low is broken. If we do break yesterdays low, look for support at 1.2917, 1.2904 & 1.2884 with 1.2832 & 1.2795 being further support below. To the upside, resistance will be strong at 1.3005 with both the Weekly R1 & Daily R1 meeting at this level. If yesterday's high is broken prices could charge higher through resistance at 1.3055 & 1.30884 before hitting the Weekly R2, and 50% retracement level for the bearish move which began on November 20 of 2011 to the 2 year low at 1.2128. No matter how you slice it, resistance is strong at this area on the chart, and a fall is very likely...but a break of yesterdays high could signal a new or continuing bull run and offer up some interesting trading as we cross the halfway mark for this week.

Happy Trading!