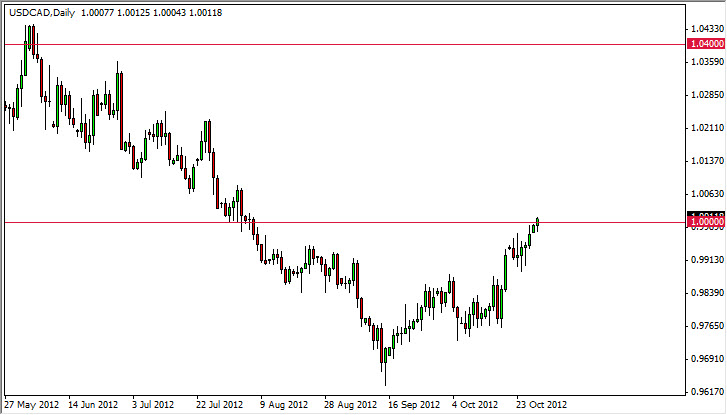

The USD/CAD pair rose during the session on Monday as the parity level finally gave way. This represents a significant change in momentum as we have been grinding higher lately, but stalled just below that all-important level.

The Monday session also saw oil markets fall as well. This of course works against the value the Canadian dollar and it makes sense of this pair would rise in that scenario. As long as the oil markets continue to weaken, this pair should continue to rise. Also, you have to keep in mind that the market in general is in a bit of a "risk off" mode right now, and as such this should continue to favor the US dollar against most other currencies.

Previous consolidation

Previously, we had a monster consolidation area between the 0.99 handle and the 1.04 level. I believe now that we have cleared not only the 0.99 resistance area, but the parity level, that we will are continuing that previous consolidation. In other words, I look at the recent breakdown is a bit of a "false breakout", and as such I think the market is going to continue to grind higher as the bias certainly favors the US dollar right now.

You have to keep in mind that this move won't come in one super spike, and that this pair does typically grind as opposed to shooting straight up. This is because the two economies are very interconnected, and as such they depend on each other for a lot of different things. Truthfully, it is probably the Canadians and the non-Americans more as they send 85% of their exports into the United States, so in a roundabout way, if the Americans are struggling then the dollar gains while the Canadian dollar falls.

I am not calling for some kind of melt up, but I do recognize the fact that global growth was slowing as well as corporate profits. With this kind of situation, and the fact that the oil markets are following, is very difficult to imagine a scenario where the Canadian dollar suddenly gets stronger. Adding to all of this is the fact that the Bank of Canada has recently been very dovish in their comments, and as such the market has had to reprice the possibility of rate hikes coming from Ottawa.