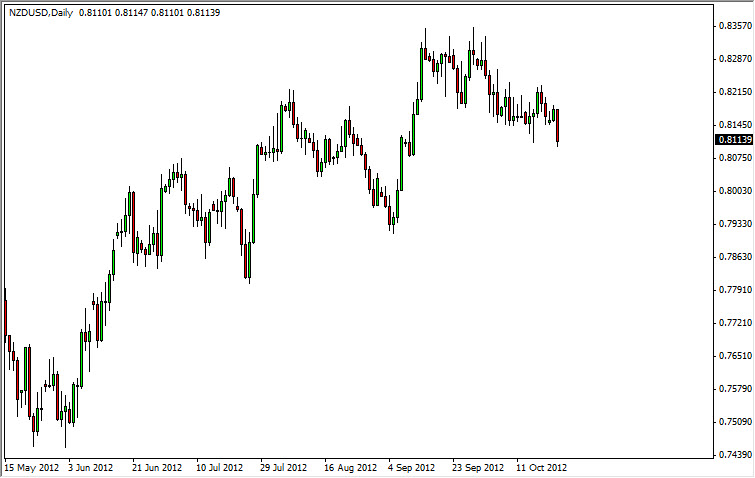

The NZD/USD pair fell during the session on Tuesday as the riskier assets around the world lost value. The 0.8100 level is a support area that has held up in the past, but is currently being pressed upon by the sellers. Looking at this chart, it does indeed look like were about start falling again.

I see the next major support area at the 0.79 handle, and think that we will eventually revisit that area. New Zealand has the unfortunate luck of being an exporter nation of commodities, and often used as a vessel to trade the general risk appetite of the world financial markets. Never mind the fact that the Kiwi's basically export agricultural goods that are needed, and not wanted, as it simply get slapped around with the commodity markets on the whole.

Less liquidity, more movement

One of the great things about the New Zealand dollar is the fact that it moves much quicker than the Australian dollar, although it does tend to move in tandem. Because of this, if you want a little bit more volatility, this is the pair for you. This is simply because there are less trades and therefore less liquidity in this particular currency pair.

With the lowered amount of liquidity, this pair can often move in exaggerated ways. As you can see, the last rally was straight up for about six sessions. There is nothing that suggests that this pair can do the same thing in the opposite direction. In fact, it is well-known that the Kiwi dollar will absolutely crumble when bad news hits.

There is a real chance of bad news coming out of various places around the world. China only needs one bad headline to have everybody freaking out yet again. Europe is simply a basket case that everybody is trying to ignore, but occasionally the headline comes across everybody has to pay attention to. The United States is barely clinging onto growth, and if it falls into recession there is a serious chance that commodities will fall as well. If commodities fall, this pair will too.

I like selling this pair, on a break below the 0.81 handle. If we get a rally at this point in time, I would need to see the pair break above the 0.8250 level in order to be convinced of the bullishness.