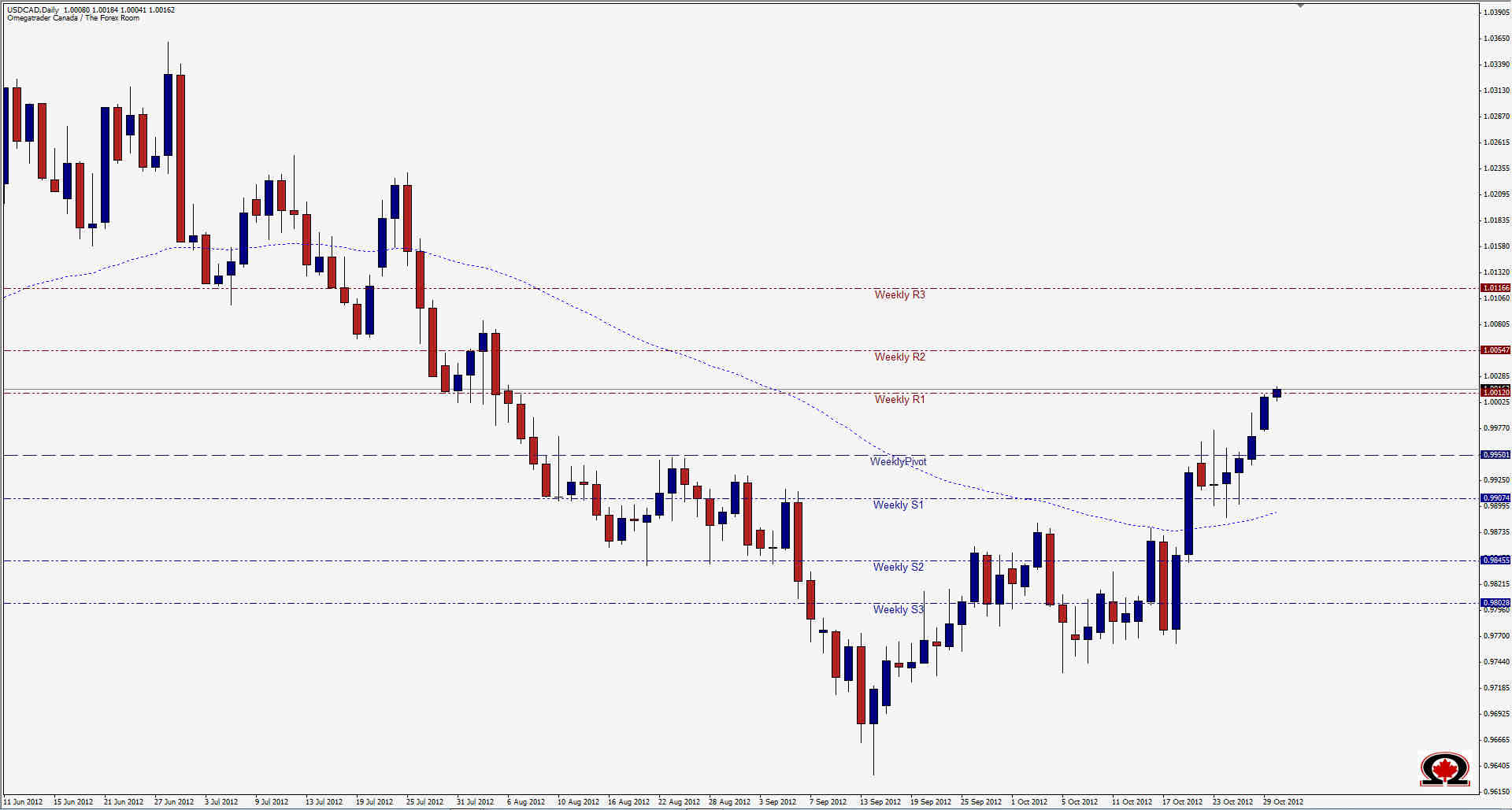

The USD/CAD, known as the Loonie to us Canucks is back at parity with its southern cousin the American Greenback. Price crossed the 1.00 threshold yesterday and has been trading slightly higher during Asian trading today. Parity is a strong level of resistance for this pair, having spent at least 12 weeks attempting to break higher between February and April of this year with no success until May when it skyrocketed to the 12 month high at 1.0446 before falling to the 12 month low in September at 0.9632. This is good for Canadian exporters, but not so good for shoppers and vacationers from Canada planning trips to the USA. The question now becomes how long will it last? Canada's economy is maintaining its own in a rather unstable world economy thanks to Canada's natural resources like oil and even Gold. But with Crude and Gold both down at the moment the Loonie is being dragged along with it. If oil turns around, and we know it will...then the Loonie could come back to life and push back below par, but if oil continues to falter for awhile then we could be looking at this pair hitting 1.0055 or 1.011 before long. Both of these areas are strong resistance and have seen the pair reverse or stall many times once achieved. To the downside support is now 1.000 of course, but the zone between 0.9907 and 0.9950, which are both strong support, is a key area for the pair which often finds itself trapped in between these prices like cattle behind a fence. The USD does appear to be getting stronger, and depending on who wins next month's Presidential election next month in Washington, we could see this trend continue for now at least.

Loonie Revisits Parity- Oct. 30, 2012

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown....

Read more Subscribe Sign up to get the latest market updates and free signals directly to your inbox. *By registering you agree to receive communications.

Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

- Labels

- AUD/JPY