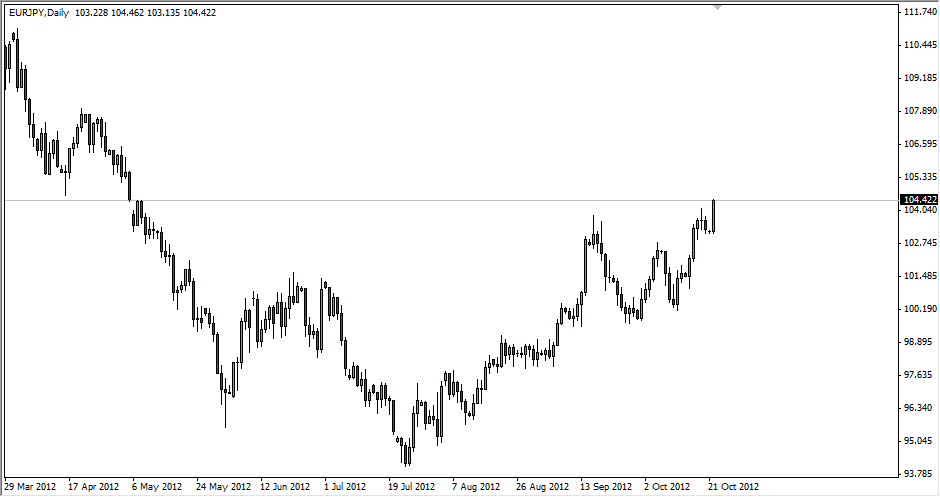

EUR/JPY had a strong day on Monday as the bulls took over in almost all “risk related assets.” Perhaps even more importantly, it crossed the 104 handle, an area that I have been wanting to for quite some time.

This marked a departure from a consolidation area between 101 04 that had lasted for a couple of months now, and I believe that measuring this consolidation area should give a very reasonable target of 108 before the move higher is done.

While I am not a big fan of the Euro in general, it must be said that the Yen is getting beat up right now as a result of the expectations of the Bank of Japan to extend its quantitative easing policies. With that possibility this week, the Yen will continue to be on the back foot and the fact that the market believes a Spanish bailout request is coming very soon gives this pair a perfect opportunity to continue much higher.

Previous resistance

One thing very interesting about the 108 level is the fact that it is previous resistance. Interesting how these symmetrical patterns tend to work out over time, and prove themselves to be useful over and over. It's not exactly rocket science, but it makes sense that if we continue higher we would find more resistance in that general vicinity.

Of course, there is the fact that many of you will more than likely get shaken out of this type of move, that's human nature. The fact is that the market will go directly to 108, and there will be pullbacks from time to time. But in the big scheme of things it does appear this market wants to go much higher. Also, many of you may not be used to the fact that this pair can move so drastically in short amount of time. This used to be the norm for this pair, as it was one of the highfliers during the old "carry trade" days. As for myself, I am long of this pair and will continue to be until 108 is hit, or we fall back below 102.