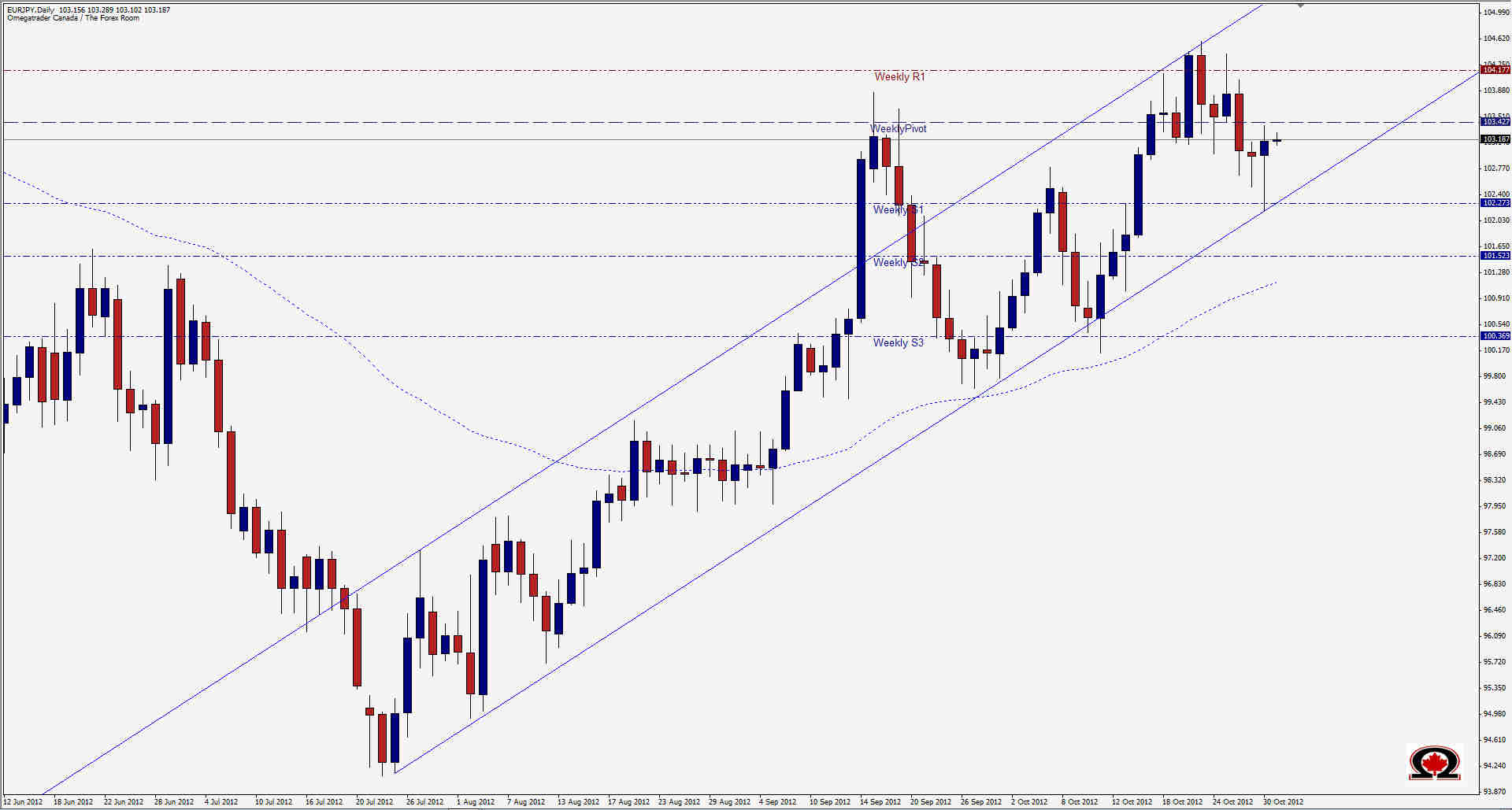

While tropical storm Sandy continues to blast the eastern seaboard in the USA and has shut down the markets for at least one more day the Asian and European markets march on. The EUR/JPY pulled a big fake out on traders at the end of yesterday's Asian session, falling some 92 pips in only minutes after the BOJ's announcement on continuing QE. The pair began reversing immediately after the London session opened and closed the day higher than it opened. This formed a bullish pin bar at the bottom of the ascending channel we see on the daily chart and hints at possible higher prices to come. The first likely target will be last week's highs but resistance sits in the path at 103.42 and again at 104.10 where both the Monthly R1 and Weekly R3 meet. To the downside we find support at the edge of the channel, 102.27 where the channel meets the Weekly S1. If that zone should fail and we close below yesterday's low at 102.17 look for the pair to pause at support of 101.50-101.60 where the Monthly R1 and Weekly S2 converge with the ascending channel for a triple whammy of support...however, if these zones are achieved it is possible that the bullish trend is over and favor shifts to the bears. The Monthly pivot sits on a strong level of support also at 100.62 which is probably where the bears will take a break if price gets back down there anytime soon. The pair is certainly more bullish than bearish so long opportunities are probably better options.

EUR/JPY Channel Holds- Oct. 31, 2012

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown....

Read more Subscribe Sign up to get the latest market updates and free signals directly to your inbox. *By registering you agree to receive communications.

Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

- Labels

- EUR/JPY