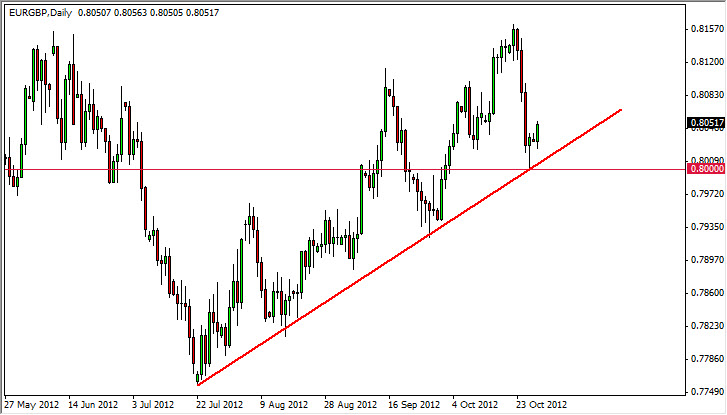

The EUR/GBP rose during the session on Monday after printing a pretty impressive hammer on Friday. This hammer caught my attention originally because it formed right on the 0.8000 level, which of course is a massive and large round number. The shape of the candle was also promising; as the body was very short, and this means of course that we closed almost at the opening price.

Adding to the bullishness of this candle that was printed on Friday were two other things in my opinion as well: the trend line, and the fact that the British pound has been struggling all of the sudden. As the Euro isn't necessarily a currency iolite, I do have to be somewhat suspicious about these types of trade, but it must be said that it seems the British pound is on the back foot right now, and the Euro is getting a bit of a reprieve. So by that logic, this trade makes sense at the moment.

Confluence

One of the greatest things that you can look for any Forex trade is the concept of confluence. This simply means that you have several things coming together at the same time giving you the same signal over and over. In this particular case, we have the weakening British pound, which of course makes you a little bit leery to buy it at the moment. This in and of itself can at least tell you which direction you want to lean in this pair.

The trend line and the 0.8000 level both are areas that people would have paid attention to. The selloff has been a bit overdone over the last week, and as such this bounce makes sense as well. In this type of scenario, I'm very interested in going long.

As for selling is concerned, it would take a sustained close below the 0.8000 level for me to be interested. I suspect that we will continue to grind higher as his pair typically does, and as such this won't necessarily be a quick trade. However, I am currently looking at gaining a bounce 100 pips or so as I think we will test the highs again.