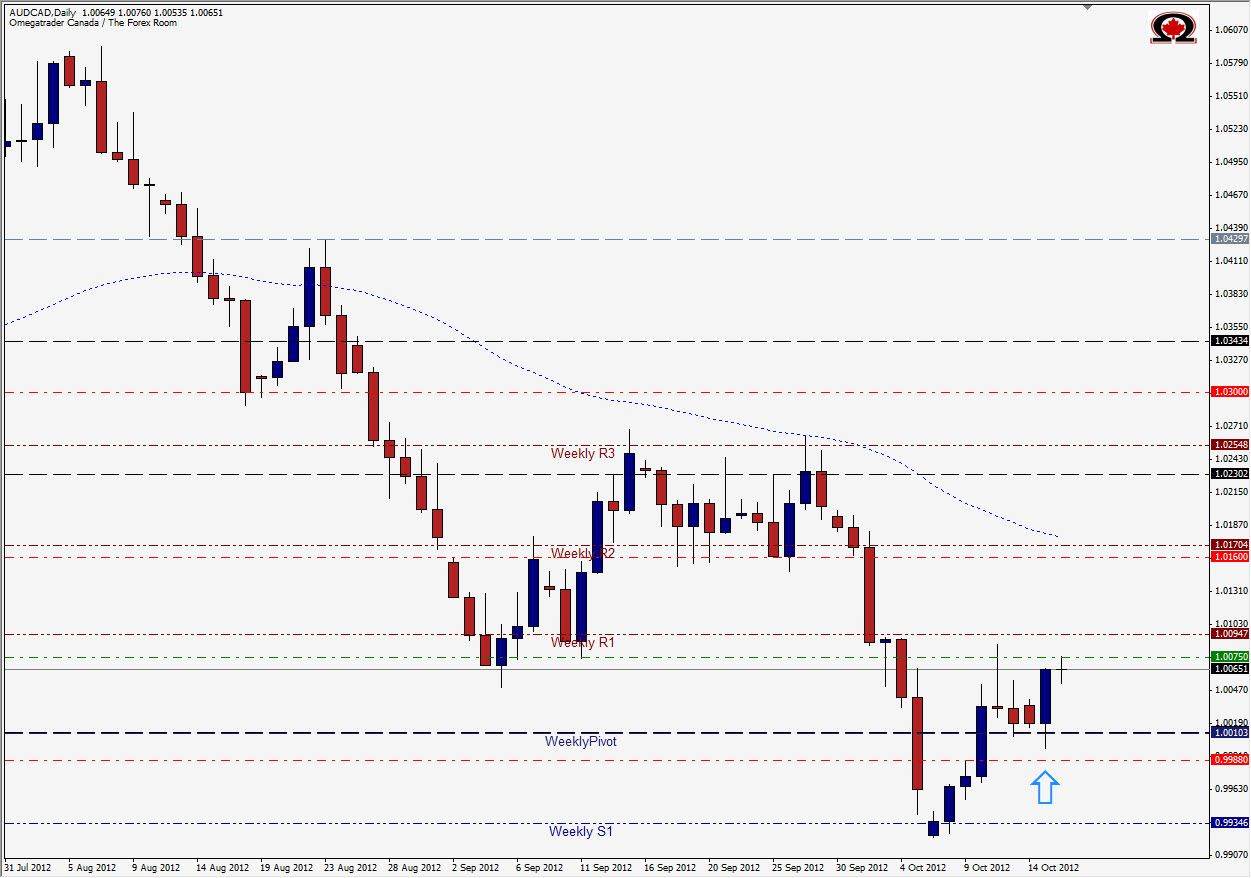

The AUD/CAD daily chart printed a Bullish Engulfing candle yesterday after consolidating between 1.000 & 1.0080 for most of last week. The pair spend last week consolidating, but had a definite Bearish undertone to the price action, closing each day lower than it opened. The pair now faces resistance from the September lows in the 1.0080 area once again and must clear this zone in order to continue the bulls' push. The next key level will be at 1.0230 where a glance at a weekly line chart will show that there have been a number of reverses in price action at said level, just like there have been many reversals at the 0.9920 area where this pair reversed only a few days ago. If the zone around 1.0230 can be breached we will look for price to push for 1.03000 where June and August lows reside. This pair is tends to move back and forth in relatively large moves, so if this is a true to form bullish reversal we could see this pair attempt to climb back up to 1.0500 before the bears take over again for a bearish trend reversal. Intraday support can be found at 1.0042, 1.0020 & 0.9975 with intraday resistance at 1.0088, 1.0110 & 1.0156.

Happy Trading!