By: DailyForex.com

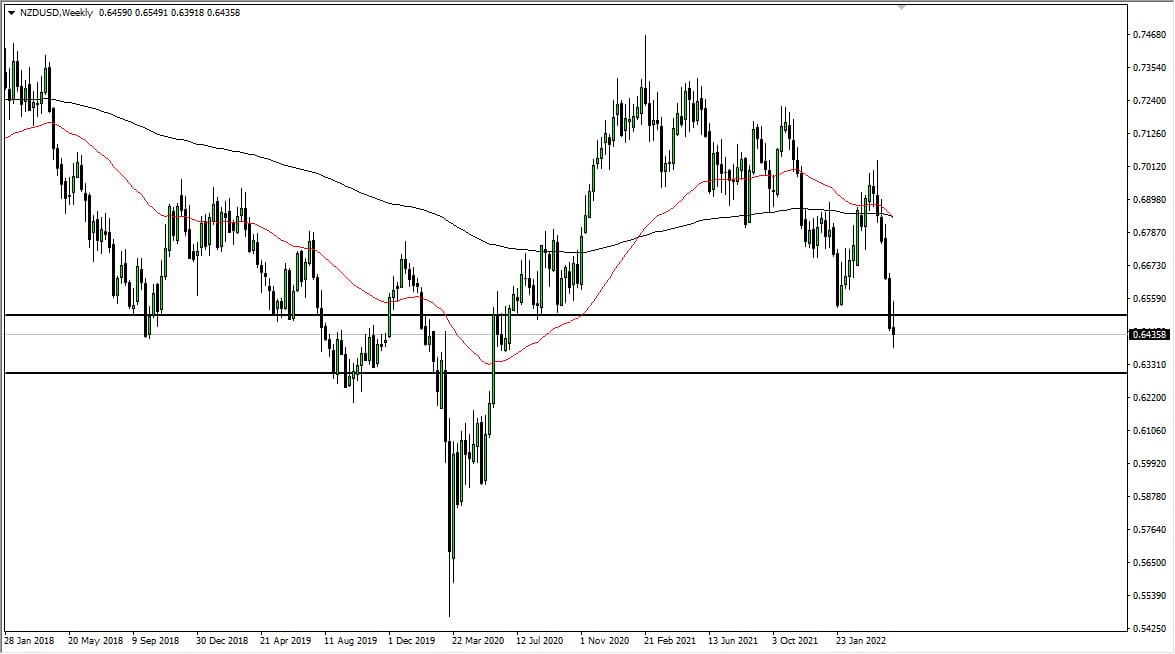

The NZD/USD pair attempted to rally during the session on Friday, but was surprisingly stalled by the sellers just 24 hours after quantitative easing by the Federal Reserve was announced. With its seemingly "unlimited" easing policy, one would have thought the US dollar would've gotten beat up quite a bit more by the Kiwi dollar. However, Friday saw a bit of a reversal and it did in fact form a shooting star which was fairly surprising to me.

I recognize the fact that the 0.83 level is resistance, and we simply have found it there. I think a shooting star isn't the sign of some kind of big meltdown coming, rather a chance to buying this pair at cheaper levels as it pulls back. My first obvious support level is the 0.82 handle, and I will be looking for supportive candles in this general vicinity in order to buy this pair.

Below there, I see the 0.81 and the very obvious 0.80 levels as support as well. As long as the Federal Reserve continues to ease its monetary policy, this pair should rise over time. However, it will be subject to extreme volatility in the face of headline news out there. This pair does tend to move quite a bit, especially on bad news.

Even though this shooting star is an excellent sell signal, I am going to ignore it as the Federal Reserve seems dead set on killing the US dollar right now. In fact, I'm not willing to sell this pair until we get well below the 0.78 level. Between now and then, I think that there are far too many support levels in which to argue with the trend over.

There will be a rush into commodities, and by extension commodity currencies. The New Zealand dollar is a nice general way to play commodity "risk on, risk off" sentiment on the whole. Because of this, and the fact that it is a less liquid currency pair, I believe it will travel much farther than some of the other usual suspects like the Canadian dollar, or even the Australian dollar.

I believe in buying dips in this currency pair, and will continue to do so as I suspect we will see 0.90 before it's all said and done. The only other thing that I can think of at this moment in time that would change things would be some type of meltdown in either China or Europe.