The GBP/USD pair rose during the Thursday session as the Federal Reserve expanded its quantitative easing policy as well as extended it. Now that the Federal Reserve has lifted all doubt on the prospects of quantitative easing 3, the market can focus on interest-rate differentials again, which of course is its natural state.

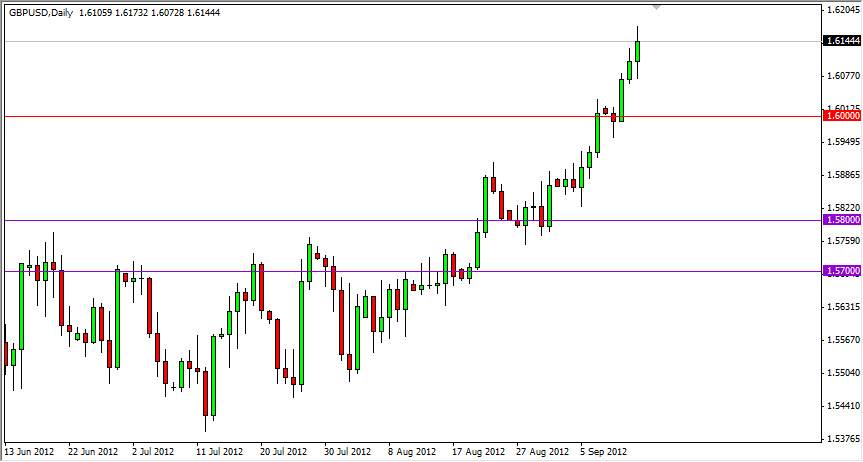

A while back, I mentioned an ascending triangle that was forming over the summertime in this currency pair. We broke out of that at the 1.58 level, and as such the measurement of the height of that triangle became important. This was the target on the breakout of this currency pair, and then target is 1.63 based upon that measurement. It now looks like 1.63 is almost a given.

Two central banks, two different worlds

Mervyn King recently stated that he was very comfortable with the monetary policy in Great Britain, and even suggested that it was "just about right." In other words, the Bank of England will not be easing anytime soon, and as such much of the doubt of interest-rate policy in London has been raised. Conversely, the markets have been assuming that the Federal Reserve will ease rates as well. During the Thursday session, it got its answer in spades.

The $40 billion a month that the Federal Reserve is going to apply to the MBS markets as well as the expansion of treasury purchases should keep interest rates extremely low in the United States. In fact, the Fed has essentially pled to keep rates low by these extended purchases until the end of 2015. Also adding fuel to the fire, Ben Bernanke suggested that he was willing to keep easing until the recovery was well underway.

Someday, this will lead to massive inflation but the Federal Reserve is hardly concerned about that at the moment. Instead, it appears that they are going to keep priming the pump until the economy rounds the corner. The cousin of this, I believe that this pair will continue to be a "buy on the dips" type of market. I especially see the 1.60 level as a bit of significant support going forward.