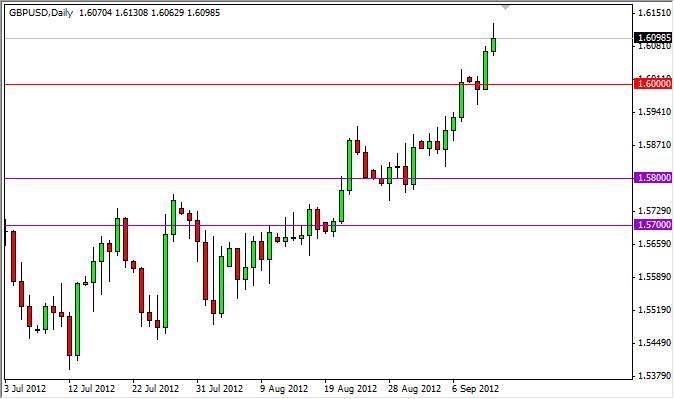

The GBP/USD market rose again during the Wednesday session as the 1.61 level was tested. Looking at this pair, it makes sense that we continue much higher as the bank of England seems to be fairly well pleased with its current monetary policy, and the Federal Reserve looks set to begin easing again. In fact, later today we should hear about the Fed's new monetary easing scheme, and this should have a massive effect on this as well as many other currency pairs.

Looking at the candle for the session, it does seem obvious of the 1.61 level has acted as resistance. However, this is without a doubt a minor area and should be essentially ignored in the big scheme of things. On a pullback to the 1.60 level it shows signs of support, I will be buying this pair.

This is because of the hammer that was formed Monday as we fell from the 1.60 level. This suggested that buyers stepped in and supportive the market at that point time. The hammer is an excellent signal for this, and as such it can't my eye immediately. Adding to the fact that it was the 1.60 level only solidified my belief in the support level. In fact, I personally feel that the 1.60 level is the "floor" of this market presently.

Target 1.63

Based upon the ascending triangle that we had formed all summer, it looked as if the market was going to head to the 1.63 level. As you can see, that isn't necessarily out of the realm of possibility anymore. In fact, this is just a scant 200 pips above where we currently trade. With this in mind, and the fact that the interest-rate differential should continue to favor the Pound for the foreseeable future, it makes perfect sense to me and I will remain long of the pair until we hit 1.63.

Looking forward, I believe that if we can get above 1.63 we are in the realm of a longer-term buy-and-hold type of situation. With this in mind, I am willing to give the market a little bit extra room when we approach the 1.63 level and keep my stops a little looser than usual.