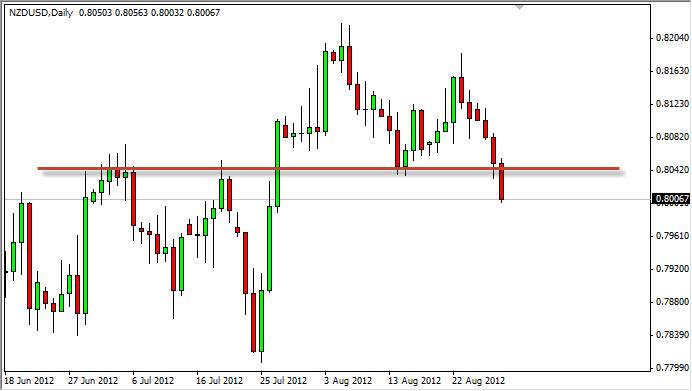

NZD/USD fell on Wednesday as the pair fell down to the 0.80 support level. The area is obviously a major number for the markets, and as such it's no surprise that this level offered a bit of support. In fact, this is one of the most important levels on this chart from a longer-term perspective as well, and as a result I am very interested in this particular currency pair at the moment.

With the Jackson Hole speech on Friday coming from the Federal Reserve Chairman Ben Bernanke, there is a serious chance that the next session or two will be rather listless until he gives that speech in the afternoon. The fact is the market will look for reasons to selloff the US dollar, as many of the participants are waiting for more "sugar" from the Federal Reserve.

This sets up an interesting situation. The market is currently waiting for this "good news", but could very well be disappointed. Even if the Chairman offers some type of monetary easing, or even just a hint of it, there's a possibility that it won't be enough. After all, the markets have been pricing in the idea of QE3, and because of this the real risk is to the downside.

0.80 As a midpoint

Currently, I see the currency pair as consolidating between the 0.78 handle, and the 0.82 handle. Essentially, the 0.80 level is the midpoint between both extremes. This is another reason why this area interests me so much. This is simply because I think the next 200 pips will be relatively straightforward once we get our trading signal.

If we break down below 0.80, I see the 0.78 level is a natural target as we short this pair. This pair is very risk sensitive so it makes sense that perhaps it will fall if Mr. Bernanke fails to give the market everything it wants. The 0.78 level opens the door to much lower prices, if of course we get below it. On the upside, if we get above 0.82 there is a real chance that we take off at that point in time. Personally, I believe that eventually this market falls but I am not willing to take that position before the Chairman speaks.