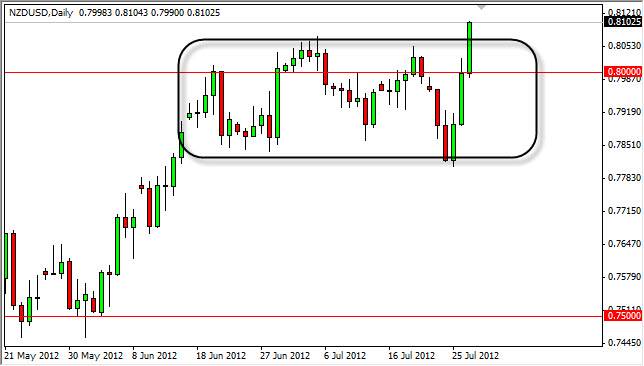

NZD/USD is a pair that I have been talking about quite a bit lately. The bounce has been wicked, and I must admit that I was caught off guard completely by this sudden burst higher. However, now that it has happened, the analysis becomes a bit clearer at this point.

The 0.8050 was a resistance area that I thought was going to hold. As we have broken through it, I can see that the momentum in this market wasn’t a “one off” like many people would have thought. This is probably in reaction to central bank easing coming from Europe, as well as the United States possibly. This of course would cause a run to hard assets, and the Kiwi enjoys that whole positive correlation with commodities thing as well.

The action on Friday was fierce, and without a doubt relentless. The pair sliced through the 0.8050 level like it wasn’t a big deal, and now looks sets to go quite a bit higher. This was in stark contrast to the Euro, which gave back most of its gains, showing that the commodity currencies are outperforming at the moment. (The Aussie did much the same thing on Friday as well.)

Three solid days

The biggest concern I would have is that the last three days have been straight up. However, this pair is a bit less liquid than the Aussie, so it tends to hold these moves a little better. I certainly am not looking at a short position now as this pair has been far too strong.

The 0.81 level is roughly were we stopped at the end of the day, but this area is simply a minor one, and shouldn’t cause major issues. At this point in time, I would suspect that any fall from this handle will simply be a chance to buy the Kiwi a bit cheaper. This is a pair that looks like buying on the dips would be a good way to go. I am not selling at all right now, and I suspect that the 0.80 level will be a bit of a floor in the short term.