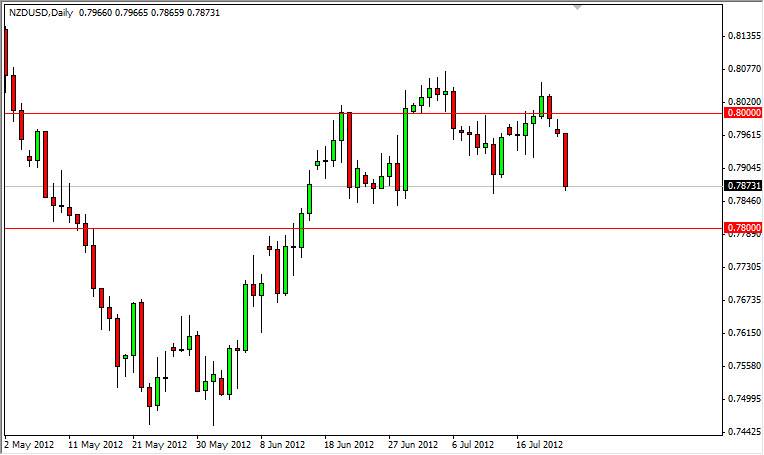

NZD/USD had a very tough day during the session on Monday, which at one point in time actually looked like it was going to turn around. However, the ratings agency Moody's came in and put several of the first tier European nations on a negative credit watch after the five o'clock close in New York to kill off what little bit of rally the Kiwi dollar managed.

However, it should be noted that we are sitting right on top of support at the 0.7850 level, which of course extends down to the 0.78 handle. Because of this, I'm not ready to sell the Kiwi dollar yet, but certainly have some parameters from which to do.

With the Kiwi been still highly sensitive to risk appetite, I think eventually this pair becomes a great selling opportunity if we get the right action. This is one of my favorite pairs to trade, as it is a cheap your risk appetite or "risk on, risk off" pair.

Major support

Looking at the charts, I see the 0.78 level as a massive support area. If we can get below that, on its daily close specifically, I would become aggressively short of this market an expected to run down to the 0.75 level in the short term. I can name of 100 reasons for this to happen, but as you know the markets are necessarily based upon reason.

It should be noted for what it's worth that the Kiwis would exactly be upset with a fall in the value of the currency. After all, they are exporting nation and higher rates to cause them harm. With at least six regions in Spain that needed bailout money, my suspicion is that headlines will continue to drive the risk appetite out of the markets. Because of this, I expect this pair to eventually fall, but I have to wait to see the signal of that daily close below the 0.78 handle in order to start selling at this point. As for buying, I would consider it on the right supportive candle, but I do not see it at this point in time.