Trades placed by optionFair

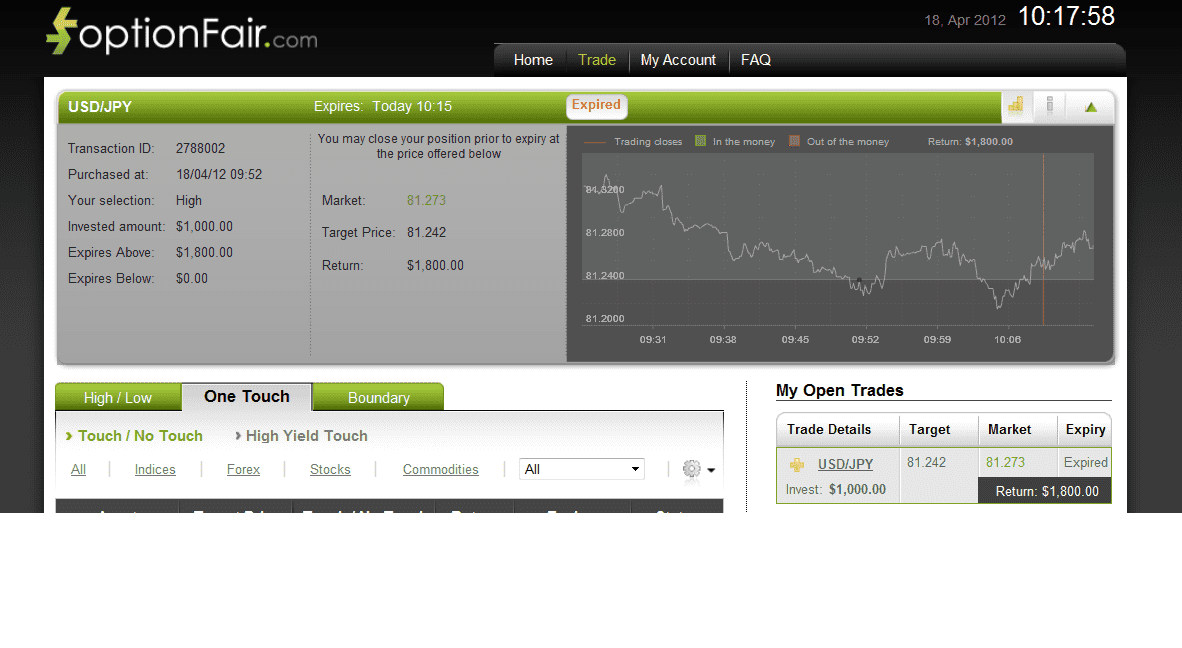

USD/JPY

According to Christopher Lewis’s analysis of the USD/JPY, the pair is expected to be bullish, meaning that “High”, “Above" and "High Yield Touch” are the relevant instruments for this situation. Keep in mind that “High Yield Touch” and the other high-yield variants are offered only on optionFair’s platform, so I’m not venturing out to any other binary options broker today.

I like nice round numbers, so I’ve placed $1000 on the “High” instrument. The return is 80% if the option expires above the strike price, which means that if the signal is correct, I will be seeing my account gain an extra $800. At the buying time (9:52), the market price for USD/JPY was 81.242. As expected, the option moved in my direction, finally expiring at 81.273. If happiness could be quantified, I’m officially $800 happier.

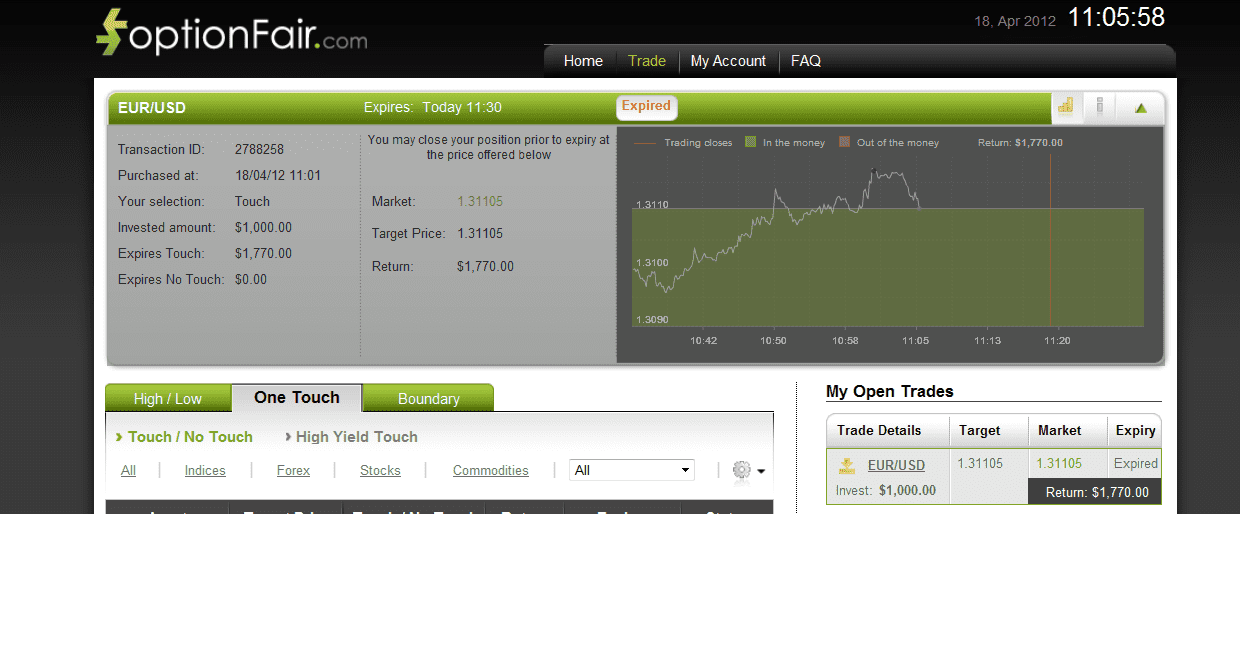

EUR/USD

As always, I’m following Christopher Lewis’s detailed analysis of the EUR/USD. According to Lewis, the Euro’s weakness is creating an investment opportunity using the “Low” or “Touch down” positions for the EUR/USD.

Using optionFair’s binary options platform, I traded $1000 on the “Touch Down” instrument.

The option carried a return of 77% if the option touches the strike price prior to its expiry, meaning that I could get a return of $770 on my $1000 investment.

I bought the option at 11:01 with market price of 1.31169. To win, I needed a target price of 1.31105, which came around sooner rather than later – it only took until 11:06 for me to win a solid $770.