Trades placed by optionFair

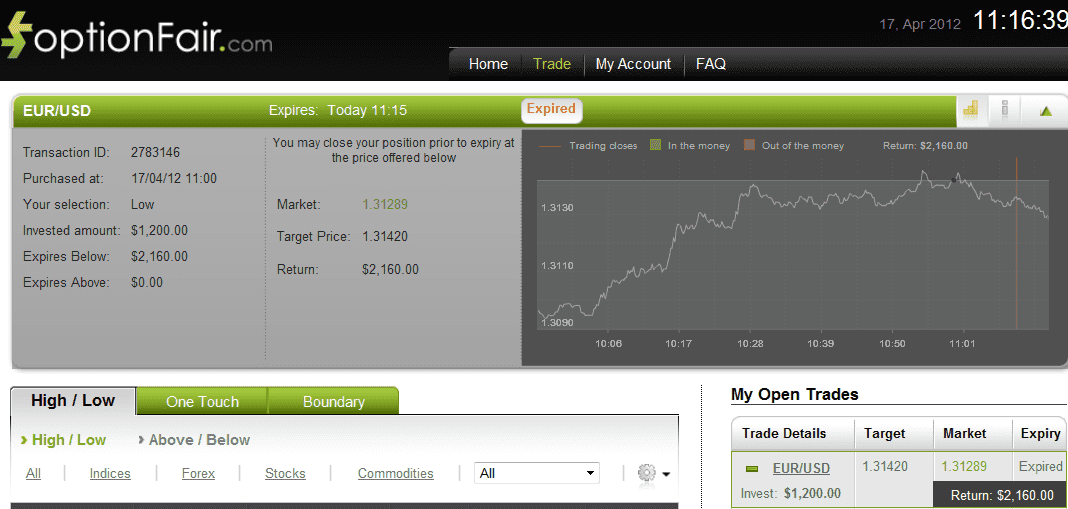

EUR/USD

The EUR/USD is by no means my favorite pair, but it had yielded some great results when following Christopher Lewis’s analysis. According to him, the pair is slated for some bearish downtime, creating some good opportunities for using the “Low” and “Touch Down” instruments, at least until the bull shows his head again.

My trade consisted of $1,200 using “Low” (80% return in the money) with the market price at 1.31420 (the time was 11:00). The option expired 15 minutes later at 1.31289 – meaning a return of $960 on my investment.

As always, I’ve been using optionFair as my broker. I’ve heard some good things about the others, but I’ve been doing great lately that I’d hate to jinx anything.

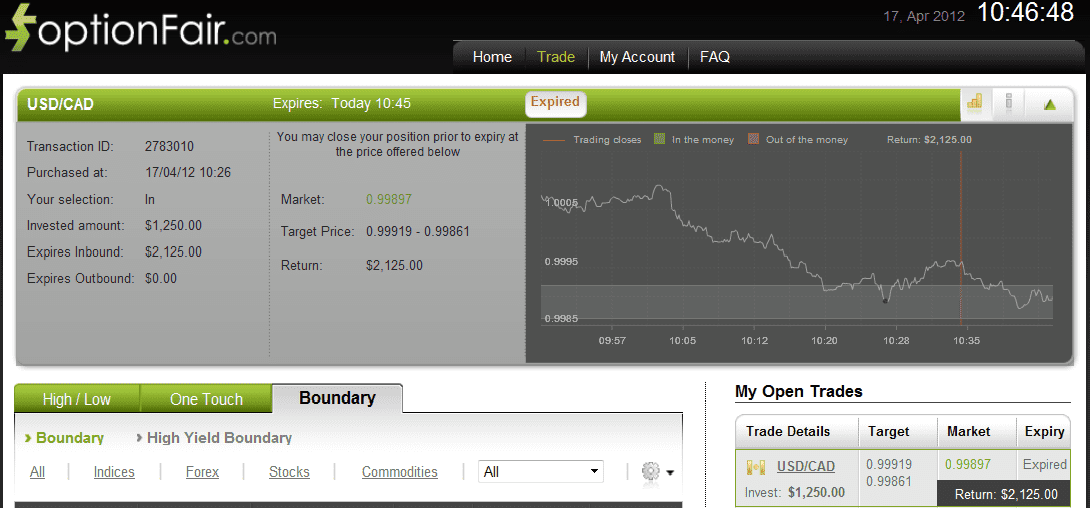

USD/CAD

I follow Christopher Lewis pretty religiously and he hasn’t failed to deliver yet again. My target today was USD/CAD. According to Lewis, the pair had a final resistance of 1.01 that had to be broken for the asset to move any higher. Furthermore, a weak candle is needed to verify movement. Before jumping in, I’ve checked with some other sources as well to see what some of the others are saying and seemed like a solid piece of information.

This type of situation is ideal for using the “In” instrument – and that’s exactly what I did. The option included $1,200 using the “In” instrument with a return of 70% if it expires within the boundaries (for some reason I feel like many traders tend to stick with just the High/Low – it’s a shame, “In” can be great in certain situations).

The market price for USD/CAD at the buying time (10:26) was 0.9989 and the boundary range was 0.9919-0.99861 slated for a 10:45 expiry.

The option eventually expired at the price of 0.99897 (within the boundary). Some quick math reveals a hefty return of $875 – good money for less than 20 minutes!

As for my broker - I’ve been using optionFair for quite some time now. After some bad experiences with some other brokers, I decided to jump ship after hearing some good things about optionFair’s tech, and it didn’t disappoint.