By: Christopher Lewis

AUD/JPY is a pair that I have been writing about quite a bit lately. This is mainly because the pair is so informative in general. The “risk on” and “risk off” attitude is clearly shown in this pair most of the time, and it is very correlated with such major financial indices like the S&P 500 that are easily followed.

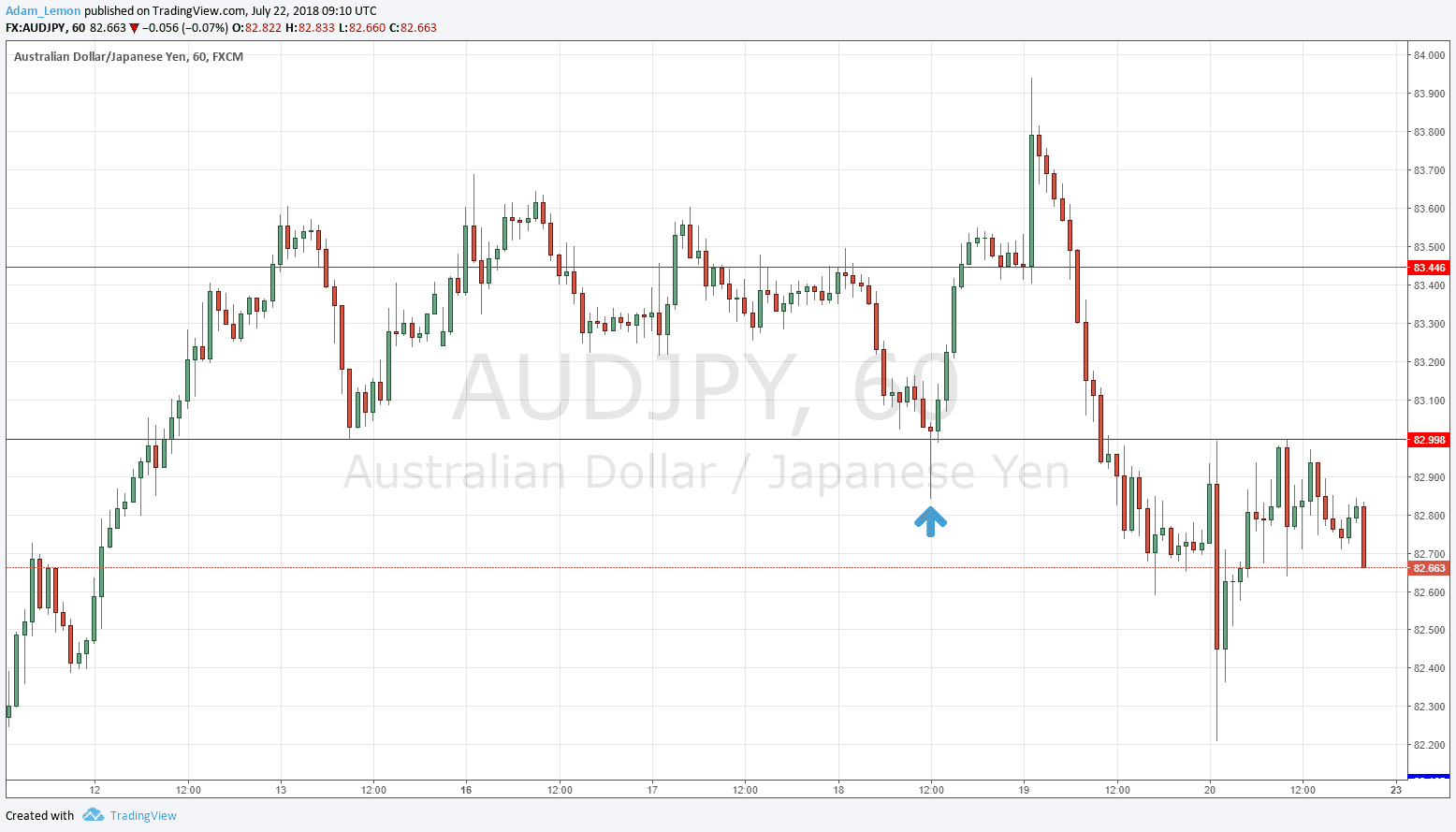

With this in mind, the triangle that we broke out of in this market signaled that perhaps we were going to enter another “risk on” situation around the various markets. The chart can often be used to judge whether or not you should be thinking of buying stocks or not, or even if you should be looking at safety plays such as US Treasury bonds as the risk sentiment falls. Because of this, the AUD/JPY pair is one you would be well served to pay close attention to, even if you aren’t planning on trading it.

The recent whittling down of interest rates in several of the developed countries has put on a rush to yield, and the currency markets have reacted. The commodity markets are getting a bid, and the commodity currencies all have reacted positively as one would expect.

Pullback and Support

The pair has shot up in a fairly strong manner over the last couple of sessions, and the Thursday shooting star was a signal that longs would possibly be getting out, or at least reducing their exposure.

However, the move has been impressive, and the breakout from the triangle should mean something over time. The move was one that had real strength, and the Aussie had been strong all across the markets. It is because of this, I know that I want to buy this pair, not sell it.

Looking at this chart, you will notice that I still have the moving averages on it. The 20 day EMA (red) is starting to make a run towards the top of the triangle. That top would have been significant resistance, and one of the most basic rules of technical analysis is that support becomes resistance and vice versa. The level is 80.50, and it is also an obvious supportive area going forward. With this in mind, I am willing to wait and see how this pair reacts when we get there. If we get supportive action, it will tell me that we are going to continue higher, all things being equal. If it doesn’t show supportive price action, I will simply forget about trading this pair in either direction.