Editor’s Verdict

RebelsFunding, a more recent entrant founded in 2023 in Slovakia (an EU country), has quickly ascended to a position of prominence among traders, who regard it as a top contender in the prop trading world. Today, the company claims it has over 25,000 registered traders and has paid out more than $2 million in rewards to over 1,800 traders.

I have conducted an in-depth review of RebelsFunding’s trading conditions to answer the all-important question: Should you consider paying the evaluation fee at RebelsFunding?

Overview

Headquarters | Slovakia |

|---|---|

Year Established | 2023 |

Trading Platform(s) | Proprietary platform, Trading View |

Minimum Evaluation Fee | $28 |

Profit-share | 75% to 90% |

Daily Loss Limit | 4%, 5%, or unlimited |

Maximum Trailing Drawdown | 6% or 10% |

Funded Account Options | 4 |

Minimum Funded Account | $1,000 |

Maximum Funded Account | $640,000 |

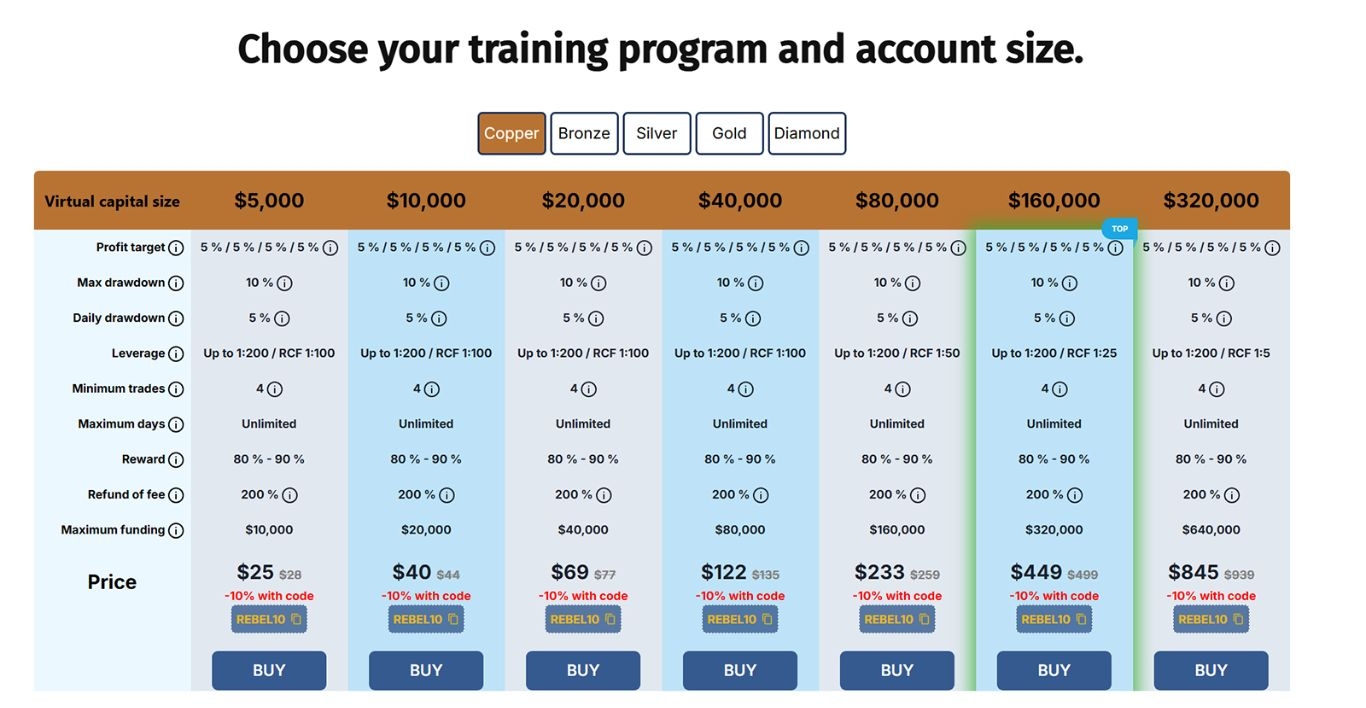

RebelsFunding offers five funding options, each with a specific number of evaluation phases, ranging from a 4-phase evaluation funding option to one that skips the evaluation phase and proceeds directly to a funded account. Each funding option also has a choice of virtual account sizes. The lowest virtual account size starts at $1,000, and the largest starting account size is $320,000. The profit sharing varies from 75% to 90% across the various options. All options have a minimum number of trades required to pass an evaluation or receive the first payout, but the main section of the website states that there is no time limit. (However, their terms and conditions state 999 days.)

RebelsFunding uses a proprietary platform based on TradingView.

I appreciate the extensive range of options that RebelsFunding offers, which allows traders with various needs to find a more customized solution for their prop trading. However, given the multiple options in evaluation phases, leverage, account sizes, and drawdown limits, traders will need to spend time determining which option is the best fit for them.

RebelsFunding Trustworthiness & Reputation

Unlike brokers, prop firms are mostly unregulated, which means that they require more research to determine their credibility. This involves researching reviews and conducting a comparative analysis of their services relative to their peers, which is precisely the type of analysis presented in this review.

Is RebelsFunding Legit and Safe?

RebelsFunding, founded in 2023, lacks a long history to judge its merits. However, to date, it has a reasonable 4.3 out of 5.0 rating on Trustpilot, based on over 1,700 reviews. Whilst this is not outstanding, it’s a respectable level, especially given that 84% of the reviews are 4 or 5 stars.

Most complaints within the 1- and 2-star reviews centred around the platform lagging. It's hard to know whether the lags were due to the RebelsFunding servers or the users' connectivity, but it was a consistent theme. RebelsFunding offers a free trial to test the platform before purchasing a program, which I highly recommend.

RebelsFunding Features

RebelsFunding has rapidly expanded in a short period, outpacing many competitors to become a prominent choice for traders through its unique platform offerings and numerous options for funded programs.

The most notable features of RebelsFunding are:

- A choice of five funded options programs

- Each program has a differing number of evaluation phases, ranging from a 4-phase evaluation option to one without an evaluation phase that proceeds directly to a funded account.

- There is no time limit during the evaluation phases (however, the small print in their terms and conditions states 999 days).

- Swap-free trading accounts

- A maximum drawdown limit of 6% or 10%

- A maximum daily drawdown limit of 4% or 5%

- A minimum number of "real trades" of 4, 5, 6 or 8 trades per evaluation phase, depending on the program. RebelsFunding defines "real trade" as "an independent, separate trade trading some current market situation.” For example, this prevents taking one trade and splitting it into two entries and exits at the same prices to try to make it count as two trades.

- A maximum daily drawdown limit of 4% or 5%.

- Profit target of 5%, 8% or 10%

- Profit sharing from 75% to 90%

- Scalping is allowed, but trades must be open for at least 30 seconds

- Overnight and weekend open trades are allowed

- News trading allowed

- EAs or system trading are not allowed

- Funded account sizes start from $1,000 to $320,000.

- RebelsFunding will increase the account sizes as the trader hits more profit targets.

- Bi-weekly reward payouts

- Evaluation fees range from $28 to $939

- RebelsFunding gives a 200% refund of the evaluation fee at the first reward payout.

Evaluation Fees & Profit-Share

Minimum Evaluation Fee | $28 |

|---|---|

Maximum Evaluation Fee | $939 |

Profit-share | 75% to 90% |

Prospective prop traders pay a one-time evaluation fee dependent on their desired funded account size and evaluation type. Each of the five program options has a choice of virtual capital size, which determines the evaluation fees.

RebelsFunding generously provides a refund of between 100% and 200% of the evaluation fee at the first reward payout, depending on the program.

The profit share starts at 75% and increases to 90% depending on the program and the account's scaling.

Account Types

RebelsFunding has five funding options:

- Copper with a 4-phase evaluation process

- Bronze with a 3-phase evaluation process

- Silver with a 2-phase evaluation process

- Gold with a 1-phase evaluation process

- Diamond, which skips the evaluation phase and goes straight to a funded account. The first payout is given when the trader hits a 10% profit target.

What are the Trading Rules at RebelsFunding?

Once a trader chooses a program and a virtual account size, they pay an evaluation fee. RebelsFunding refunds this fee upon completion of the evaluations, and for some programs, the refund is 150% or even 200%.

The RebelsFunding main website states that there is no time limit to complete the evaluation, but the terms and conditions specify 999 days (approximately 2 years and 9 months).

Each program contains a percentage profit target, a maximum drawdown from the initial balance and a daily drawdown limit.

The trading rules for the RebelsFunding evaluation are:

- Copper: 5% profit target over 4 evaluations; 10% maximum drawdown; 5% daily drawdown; minimum 4 trades; 80%-90% profit share

- Bronze: 5% profit target over 3 evaluations; 10% maximum drawdown; 5% daily drawdown; minimum 4 trades; 80%-90% profit share

- Silver: 8% and 5% profit targets over two evaluations; 10% maximum drawdown; 5% daily drawdown; minimum six trades; 75%-90% profit share

- Gold: 10% profit target over 1 evaluation; 6% maximum drawdown; 4% daily drawdown; minimum 8 trades; 75%-90% profit share

- Diamond: No evaluation; 10% profit target for first payout with a minimum of 5 trades; 6% maximum drawdown

Rebels Funding Five Funding Program Options

Noteworthy:

- All trades are executed within a simulated environment with real-time price quotes, but RebelsFunding may choose to replicate trades in their live accounts.

- RebelsFunding will scale up the account sizes when traders hit profit targets over several months.

- The leverage decreases when moving from the evaluation phase to the funded account phase.

- The terms and conditions give RebelsFunding discretion to close accounts due to trading behaviour they consider risky, fraudulent, or otherwise inappropriate.

- Traders can trade Forex, metals, some stock indices, cryptocurrencies, individual stocks, and energies.

Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

RebelsFunding uses a proprietary version of TradingView. Many traders globally have used TradingView, and it is becoming as popular as MetaTrader. For traders who are new to it, learning is easy, with plenty of support available.

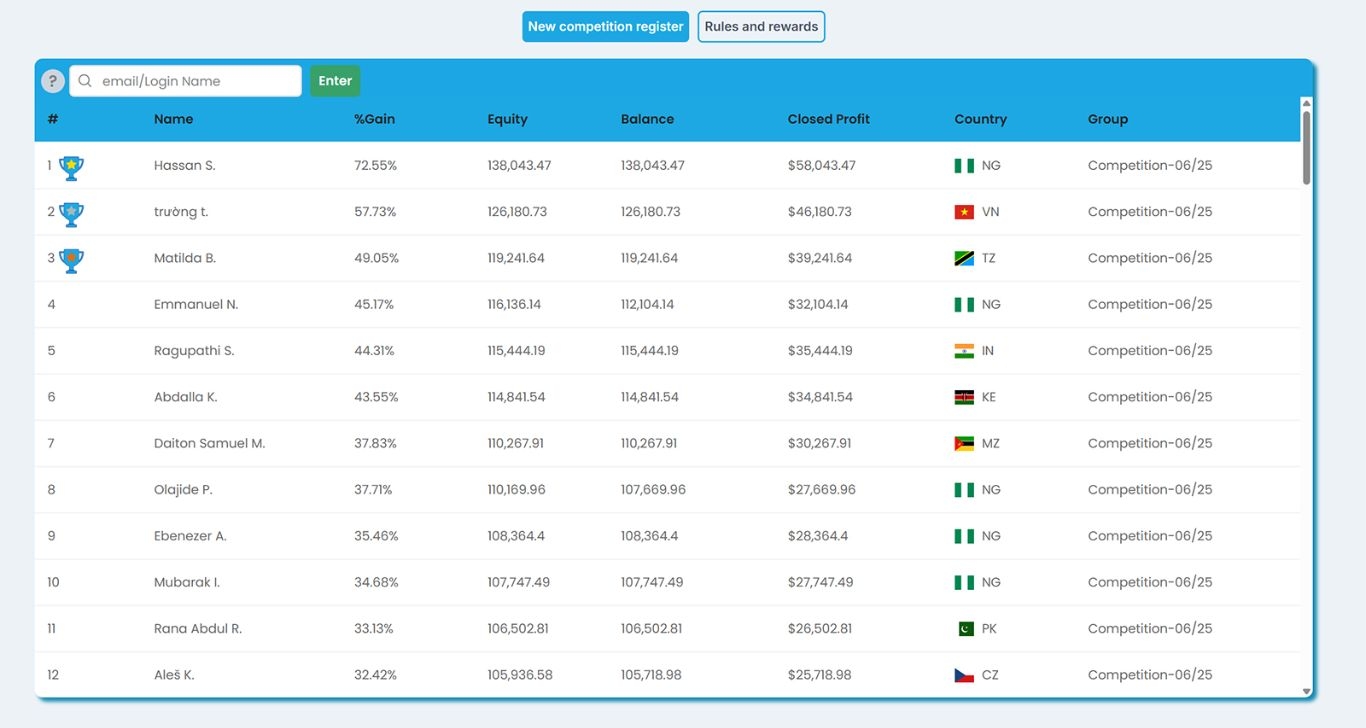

Education

RebelsFunding offers a Forex course containing 29 modules for registered traders. They also run a regular competition, and traders can access the competition leaderboard and view the complete trade history of any competitors. That means traders can essentially study what the best traders in the competition are doing and even try to reverse-engineer their strategies. Registered traders can also access the utilities section, which includes an economic calendar, heat map, and Forex screener.

RebelsFunding Competition Leaderboard

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |  |

RebelsFunding offers customer support through email and live chat. They have a back-end request form for traders to receive profit sharing. There were virtually no complaints in the Trustpilot reviews of RebelsFunding not paying out rewards.

How to Get Started with Funding Traders

I recommend traders begin with a free trial to test the platform. Once satisfied, the next step is to choose one of their programs and a virtual account size.

Minimum Evaluation Fee

The minimum evaluation fee is $28 for a $5,000 account in their Copper program.

Payment Methods

RebelsFunding accepts bank transfers, wire transfers, PayPal, Venmo, credit/debit cards, cryptocurrencies, NGN, and physical checks.

Accepted Countries

RebelsFunding accepts traders resident in any country Syria, Democratic People's Republic of Korea, Iran, Iraq, South Sudan, Sudan, and Yemen.

How to Pay the Evaluation Fee?

Traders can pay by credit or debit card, cryptocurrencies, PayPal, or NGN.

The Bottom Line - Is Funding Traders a Good Prop Firm?

RebelsFunding offers a vast array of choices, enabling traders to tailor their needs to a specific program and account type. Their requirements are reasonable, such as drawdown limits and a minimum number of trades to achieve the profit targets. I recommend that traders first test their platform during the free trial to ensure it meets their needs and offers the markets they wish to trade. The reviews from individual users are strong, with 84% of reviewers rating them 4 or 5 stars (out of a total of 5 stars) on Trustpilot. I can recommend them to traders, provided they verify that the prop firm is suitable for them through the free trial.