Many of us think of currency trading in terms of spot transactions, but a significant portion of the market consists of FX Forwards and FX Swap contracts. These contracts are popular because they offer flexible, sophisticated ways to hedge currency risk.

Let’s explore what FX Forwards and FX Swaps are, how they work, their differences, and how they meet the needs of different types of market participants.

Top Forex Brokers

How Do FX Forwards Work?

To help us understand how FX Forwards work, let’s compare them to spot contracts.

If I walk into a store and buy a bag of apples at its current price of $5, this is a spot contract. However, if I instead tell the cashier I want to agree to buy the apples one week from now for $5.50, I have set up a forward contract.

Applying this logic to FX, an FX spot transaction is the immediate exchange of two currencies at the current exchange rate, i.e., the “spot price.” Spot transactions are the simplest to understand, and most speculative retail Forex traders such as myself operate in the spot market.

In comparison, an FX Forward is a contract to exchange one currency for another at a specified price (which may differ from the current spot price) at a specified future date. The settlement price and date do not change, regardless of how the market price fluctuates.

Here are the full features of an FX Forward contract:

- An FX Forward contract locks in a price to exchange one currency for another at a specified future date.

- FX Forwards are privately negotiated agreements between two parties, i.e., they are over-the-counter (OTC) contracts. Unlike futures contracts, FX Forwards do not trade on exchanges.

- An FX Forward has a single settlement upon the contract’s maturity, meaning they do not trade or change hands before the maturity date.

- FX Forwards are customizable to meet specific needs, for example, the currency pair, the contract value and maturity date.

- Typically, the difference between each currency’s interest rates determines the Forward price. For example, for a GBPUSD Forward contract, if UK interest rates are higher than US interest rates, the Forward price would generally be higher than the spot price. Whereas, if the UK’s interest rate were lower than the US's, the Forward price would be lower than the spot price.

What is an FX Swap?

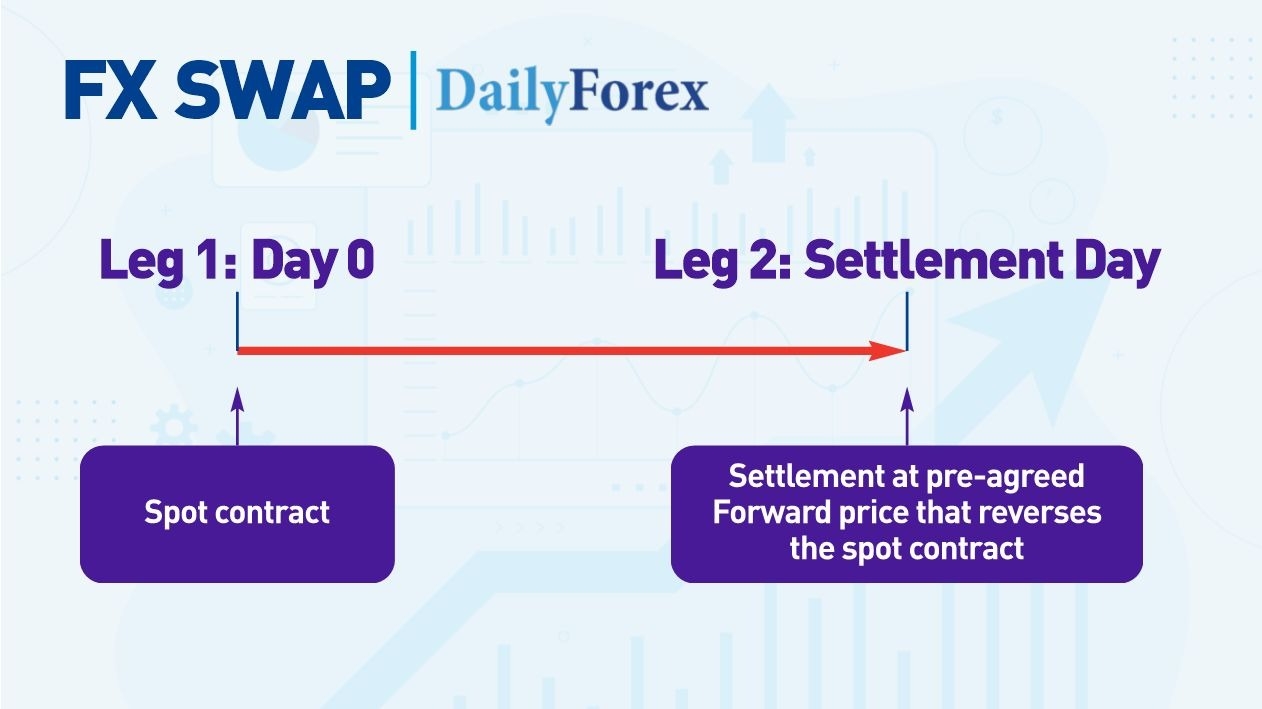

An FX Swap is a spot contract combined with a Forward contract:

- Leg One, or the “Spot Leg”: A spot trade.

- Leg Two, or the “Forward Leg”: A Forward contract of the same size as the spot contract but in the opposite direction.

Let’s take an example of a 90-Day EURUSD FX Swap for 1,000,000 euros, with a EURUSD spot rate of 1.1000 and a Forward rate of 1.0950.

- Spot Leg (Day 0): A company agrees to buy €1 million and sells $1.1 million.

- Forward Leg (Day 90): The company buys back the $1.1 million and returns €1,004,566 ($1.1 million divided by 1.0965).

The institutions issuing FX Forwards and FX Swaps will automatically calculate the pricing based on the interest rate differences between currencies.

FX Swaps are a massive business for institutions. If you want to learn more about how institutions trade FX Swaps, a great source is Gary Stevenson’s 2025 book, The Trading Game. Stevenson is a British trader who worked for Citibank, one of Europe’s largest banks, and made millions trading FX Swaps on Citibank’s behalf.

FX Swap vs FX Forward: Which Is Better?

Both FX Forwards and FX Swaps manage currency risk, but they have different uses. FX Forwards hedge a single fixed future payment. The FX Swap does that as well, but it also provides immediate liquidity in another currency through the initial spot leg.

Example 1: Let’s say I am a U.S.-based manufacturer and have sold a product priced in Euros that I have to deliver to a German customer in six months. In this case, I may use an FX forward to lock in the EURUSD rate for straightforward hedging. If I do not hedge, I could receive less in US Dollars in six months if the US Dollar rises in value against the Euro when I deliver the product.

Example 2: Let’s now say I am a U.S. business sourcing supplies from Europe and selling to European customers. In this case, an FX Swap allows me to temporarily convert from US Dollars to Euros and back to US Dollars, and lock in the rates so I am not affected by adverse currency movements.

When comparing FX Forwards to FX Swaps, I must consider my currency usage to determine which is the best fit.

Types of Currency Swaps

Currency swaps vary, most notably in how they treat the interest rate components. Here are three common types:

- Fixed-for-Fixed currency swap. Both parties pay fixed interest rates in different currencies, with the principal exchanged at the start and end. This is useful for funding in another currency or hedging foreign currency debt.

- Fixed-for-floating currency swap. One party pays a fixed interest rate in one currency, and the other party pays a floating interest rate (e.g., LIBOR) in the other currency. This continues to hedge currency risk but also manages interest rate risk. For example, one party might have liabilities tied to a floating-rate loan denominated in a separate currency, and a fixed-for-floating swap can match these liabilities.

- Floating-for-Floating Currency Swap (Basis Swap). Both parties pay floating interest rates in different currencies.

Examples of using FX Forwards and FX Swaps

- Cross-border payments. For example, if a real-world business exports goods, it may use FX Forwards to lock in currency rates against adverse movements. For example, a US manufacturer receives an order from the UK for its product priced in British pounds, with delivery due in 3 months. However, if the US dollar strengthens against the British pound, the manufacturer will receive less in U.S. dollars for the order. A solution is to use an FX Forward to lock in the exchange rate for 3 months.

- Corporate treasury funding. If a company has loans with interest payments denominated in different currencies, it can use FX Swaps to help manage payments and protect against adverse currency and interest rate changes.

- FX Forward Roll. FX Forwards have a fixed settlement date, but the original circumstances may change between the issue and settlement dates, requiring one of the parties to extend the terms. This is possible through a process called “FX Forward Roll.” A standard method is to pay the counterparty the Forward contract’s marked-to-market price and enter into a new Forward contract.

Pros and Cons

Pros:

- FX Forwards and FX Swaps lock in exchange rates, protecting against adverse currency movements. This is a form of hedging or risk management.

- They are highly customizable agreements that can match business and cash-flow needs.

- There are no upfront costs (i.e., premiums) with FX Forwards and FX Swaps.

- In particular, FX Swaps are excellent tools for managing currency exposures that continuously change and managing short-term liquidity needs in different currencies.

Cons:

- The FX Forward or Swap holder is obliged to complete the transactions of the terms at the settlement date, even if the market has moved in their favour, making the terms of the Forward or Swap less attractive. In other words, participants cannot take advantage of favourable market moves during the contract term.

- Counterparty risk. FX Forwards and Swaps are over-the-counter (OTC) contracts that are not guaranteed by exchanges, increasing the risk that one party will not fulfill their obligations at settlement.

CFTC clarifies FX Window forwards

An FX Window forward is a type of forward contract that allows a client to execute a currency transaction at any point within a specified date range, called a "window" (which could be weeks or months long). This feature is very different from traditional FX Forward contracts, and can make them appear more like FX Swaps. Because the CFTC regulates FX Forwards and Swaps differently, in April 2025, it issued a letter clarifying that FX Window Forwards fall under FX Forwards, not FX Swaps, for regulatory purposes.

Tips for choosing the best tool

- First, determine whether there is a need for hedging rather than a spot transaction. For example, what is the risk of not hedging? Is there a likelihood of a favourable market move that hedging would prevent? Essentially, the business needs to forecast the cost of not hedging and how risk management will help mitigate it.

- Next, determine which currencies to hedge and in what quantities.

- Then decide if you should use an FX Forward or FX Swap. FX Forwards are more straightforward but less flexible. FX Swaps are great, providing the benefits of FX Forwards and immediate liquidity in a second currency. However, the business need may not require the immediate liquidity of an FX Swap.

Bottom Line

FX Spot transactions can serve many business and speculative needs. However, many businesses must manage the exchange of goods and services for currencies over different periods, which exposes them to currency risk. FX Forwards and FX Swaps allow them to hedge the risks. These contracts are highly customizable to ensure they fit the circumstances at hand. However, they are over-the-counter (OTC) contracts, without the guarantees of an exchange, exposing them to counterparty risk — i.e., the possibility that one party will not fulfill their obligations. But when used properly, they are an excellent risk management tool in international trade.