Bitcoin (BTC) has experienced a notable decline, dropping 3% over the last 24 hours to trade at $115,100 on Monday. As the cryptocurrency market braces for Federal Reserve Chairman Jerome Powell’s highly anticipated speech at the Jackson Hole Economic Symposium, traders are waiting to see how the markets will react.

This performance follows a remarkable rally that saw BTC reach an all-time high of $124,474 last week. With market participants on edge, the upcoming speech could set the tone for Bitcoin’s next move, as traders look for clues about potential U.S. monetary policy shifts, particularly regarding interest rate cuts.

BTC Price Action Dips $10,000 from ATHs

Bitcoin’s recent price action has placed it at a critical juncture. After failing to sustain its upward momentum following last week’s peak, BTC has entered a bearish phase, losing nearly 5% of its value since Thursday to an intraday low of $114,706 on Monday. This brings its total drawdown since the $124,500 peak to over $10,000.

BTC/USD four-hour chart. Source: TradingView

The market’s focus is now squarely on Powell’s Jackson Hole address, an event historically known for influencing risk assets like cryptocurrencies.

According to analysts, Powell’s remarks could provide hints about the Federal Reserve’s plans for interest rate adjustments.

“Investor attention will be fixated on Federal Reserve Chair Jerome Powell’s Jackson Hole speech, and how the Fed is viewing the balance of risks between recent weak labor market data and rising inflation,” trading company Mosaic Asset confirmed in the latest edition of its regular newsletter, The Market Mosaic.

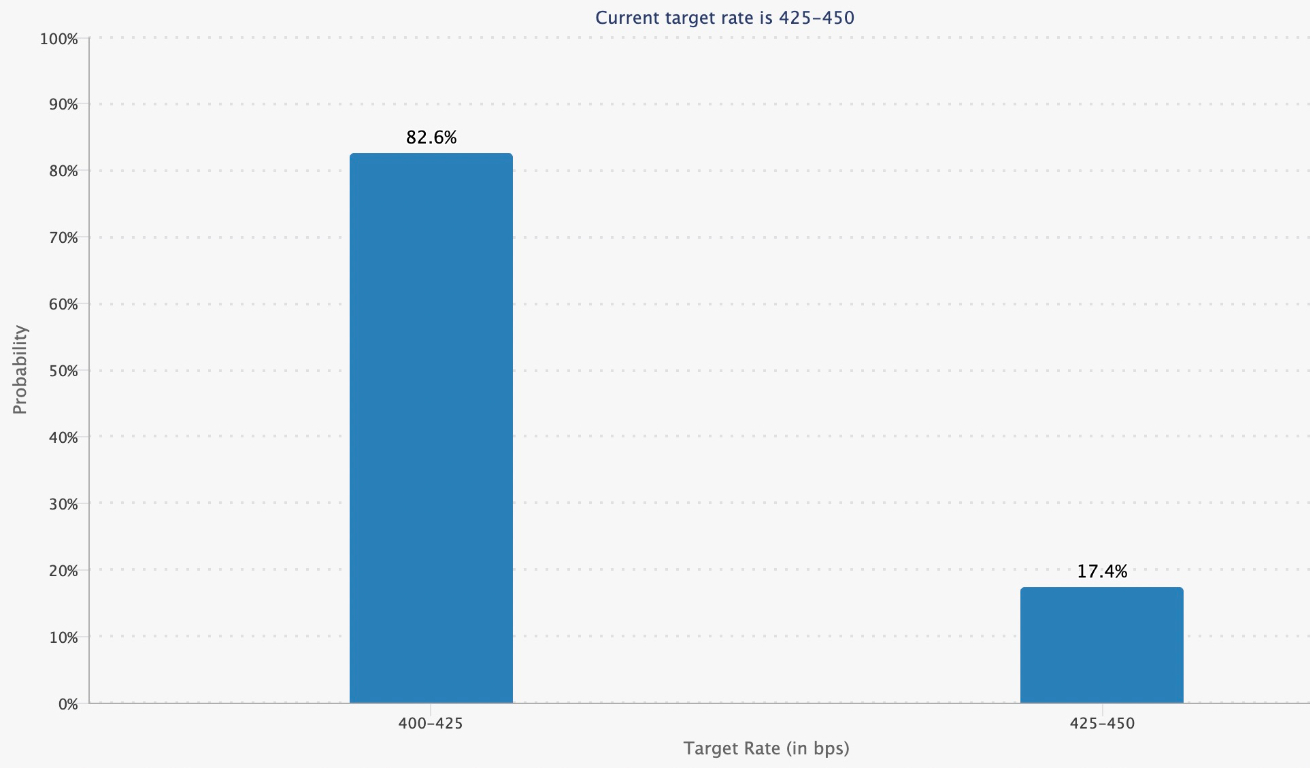

The CME FedWatch tool now indicates expectations of a 25-basis-point rate cut in September with odds standing at 82%.

Target rate possibilities of September 17 FOMC meeting. Source: CME Group FedWatch tool.

A dovish tone, signaling easier monetary policy, could bolster Bitcoin’s price, while a hawkish stance might exacerbate the current downtrend.

In 2024, a hawkish tone from Powell triggered a significant 29% drop in Bitcoin’s price, taking months to recover. While core inflation has since cooled and Powell’s communication style has become more measured, the market remains cautious.

Bitcoin’s implied volatility has dropped to near two-year lows, suggesting a period of consolidation, but this calm could precede a sharp move depending on Powell’s rhetoric. Traders are particularly wary of a repeat of last year’s scenario, where key moving averages were tested and lost, leading to prolonged consolidation.

ETF Flows and Treasury Companies Still Back BTC’s Upside

Despite the recent price dip, Bitcoin continues to benefit from strong institutional interest, particularly through Bitcoin investment products led by exchange-traded funds (ETFs).

Spot Bitcoin ETFs have recorded consistent inflows between August 14 and August 15 amassing a total of $1.3 billion in inflows. Friday August 15 saw small outflows of $14 million, as per data from SosoValue.

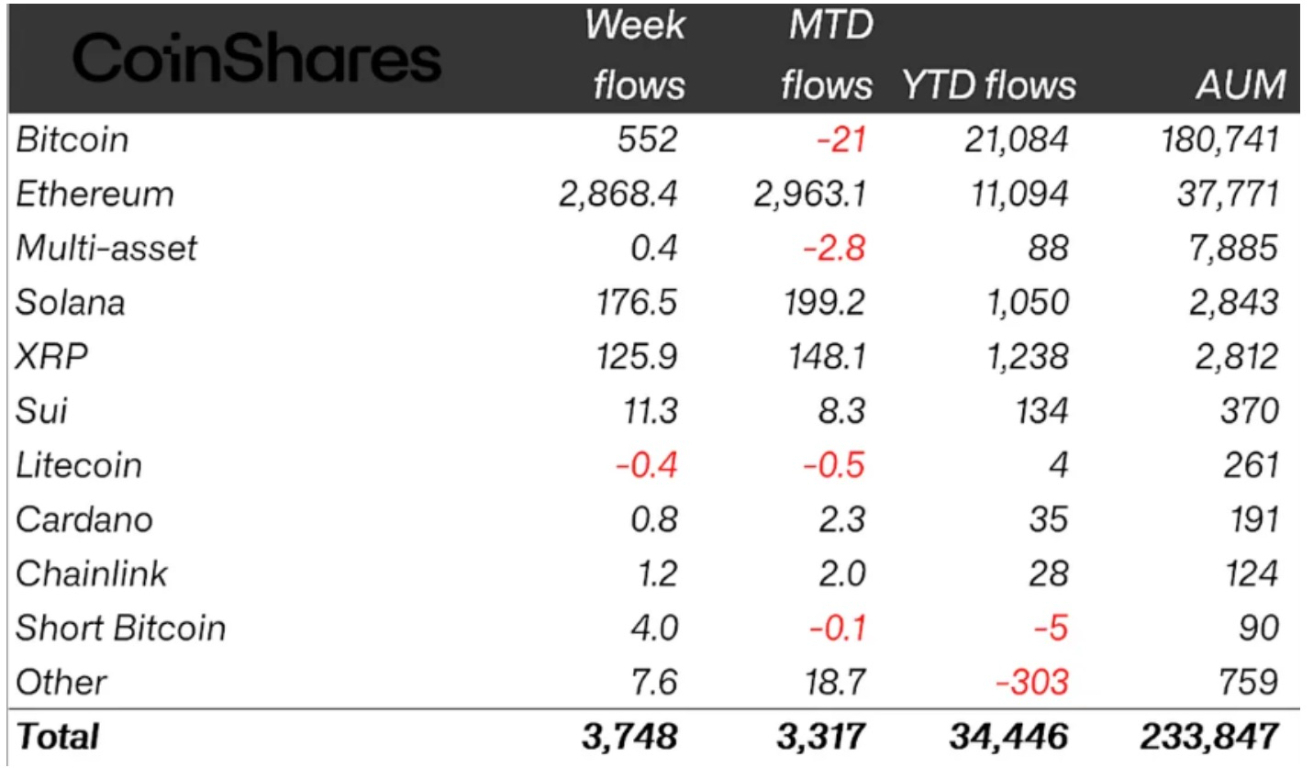

Additional data from CoinShares shows Bitcoin investment products saw inflows totaling $552 million, or about 15% of total inflows last week.

Crypto ETP flows by asset. Source: CoinShares

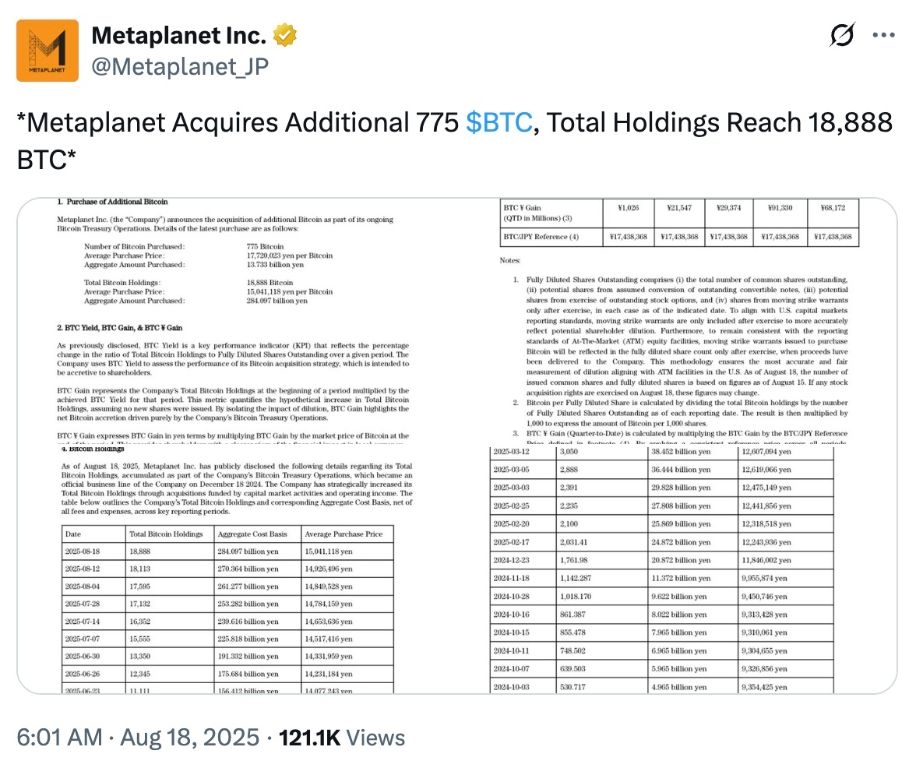

Beyond ETFs, treasury companies are increasingly embracing Bitcoin as a strategic reserve asset. For instance, Metaplanet, a Japanese firm, has announced plans to boost its Bitcoin holdings to 30,000 BTC in 2025, adding 775 more BTC on August 17 to bring its total holdings to 18,888 BTC.

Source: Metaplanet

Similarly, BitMine’s Chairman Tom Lee has endorsed a US strategic Bitcoin reserve, signaling growing institutional adoption. Tether, a major player in the stablecoin market, holds substantial US Treasuries and a $5.46 billion surplus, positioning it as a significant liquidity provider in the crypto space.

These developments underscore Bitcoin’s increasing integration into corporate balance sheets, providing long-term bullish tailwinds despite short-term price fluctuations.

Key Bitcoin Price Levels to Watch This Week

From a technical perspective, Bitcoin’s price action is at a critical point, with several key levels likely to dictate its near-term trajectory. On the downside, BTC has already breached the $116,000 support level and the 50-day Simple Moving Average (SMA) at $115,725.

A close below the $115,000 psychological level could see Bitcoin slide further to the next support zone around $110,841, aligning with the 100-day SMA. Lower than that, the last line of defense sits at the $100,000, embraced by the 200-day SMA. If this level is lost, the price could plunge into a bear market drawdown.

The Relative Strength Index (RSI) at 45 indicates that the market conditions favour the downside.

BTC/USD daily chart. Source: TradingView

On the upside, a recovery above the 50-day SMA and the $116,000 psychological level could signal a potential reversal, with bulls targeting the psychological $120,000 level. A decisive break above this could pave the way for a rally first toward the all-time highs above $124,000 and later to $130,000, a medium-term target for optimistic traders.

However, the market’s reaction to Powell’s speech will likely be the catalyst for any significant move. If Powell adopts a dovish tone, Bitcoin could regain momentum and test higher resistance levels. Conversely, a hawkish outlook could push BTC toward lower supports, potentially testing the $108,000–$112,000 range, as some analysts suggest.

Top Regulated Brokers

Ready to trade BTC? Here’s a list of some of the best crypto brokers to check out.